Are you in need of a business loan? Chances are you’ve encountered several loan applications in your search. It’s essential to keep an eye out for potential red flags to avoid falling victim to loan scams or financial exploitation.

Small businesses are particularly vulnerable, with a fraud incidence rate as high as 28%. We have outlined the top 5 red flags to look out for during the loan application process.

1. Not Doing a Credit Check

Your credit score is a top factor in determining your eligibility for a loan. Your credit score serves as a measure of your or your business’ creditworthiness and your ability to manage borrowed funds responsibly.

Trustworthy lenders utilize credit scores to assess whether they can trust a borrower to repay the loan. A higher credit score increases your likelihood of loan approval. If your credit score isn’t part of your loan application process, it’s a warning sign of a potential scam.

2. Rushing Through the Loan Process

Organizations aiming to exploit your financial situation often resort to pressure tactics to coerce you into making rushed decisions that prevent you from understanding the full scope of the loan terms. If you feel rushed to sign loan agreements without details about the loan’s terms, consider it a warning sign. Trustworthy lenders will provide you with all the necessary information and provide sufficient time to make an informed decision without feeling pressured.

3. Looks Too Good to be True

If an offer seems too good to be true, it likely is. Exercise caution if a lender guarantees approval, offers exceptionally low interest rates, or imposes no credit requirements. Understanding general market standards is wise to ensure your loan application process is legitimate.

4. Upfront Fees

Be cautious with applications that require upfront fees. Reputable lenders often deduct their fees from the final loan amount during the closing process. Upfront fees for starting a loan application are unnecessary and may indicate that the lender is trying to profit from the borrower before providing any services or funds. You should not be charged fees to access information that you need to understand your loan options.

5. Inconsistent Information

If you notice inconsistencies in the terms and conditions presented throughout your application process, it can be an indication that the lender may not be trustworthy. Additionally, if they unexpectedly alter the loan terms at the last minute or insist on signing additional documents with different terms than originally agreed upon, it could be a tactic to exploit you financially. If your contact doesn’t answer your questions or gives incomplete answers, they may be hiding important information and fees.

Bottom Line

If you notice warning signs or feel unsure when applying for a loan, it’s best to not continue with the application. Trust your instincts. A reputable lender will prioritize transparency, address your concerns, and strive to match you with the most suitable financing solution for your business.

If you need a small business loan, NEWITY provides an excellent solution that matches you with the best available small business financing option for your business. You can read more here about how NEWITY is different than others in the small business financing market.

NEWITY Provides Solutions:

- 1.) At NEWITY, we ask borrowers to provide their credit score when applying for a loan. If you have concerns about a low credit score or the impact of an inquiry on your current score, don’t worry. We run a soft pull of your credit score, ensuring that our loan application won’t impact your credit score.

- 2.) We offer our members a 30-day window from the time they receive an offer to choose their preferred loan options. During this period, our team members are available to address any questions you may have regarding the loan terms and conditions. You can reach out to a NEWITY member via phone or email at any time.

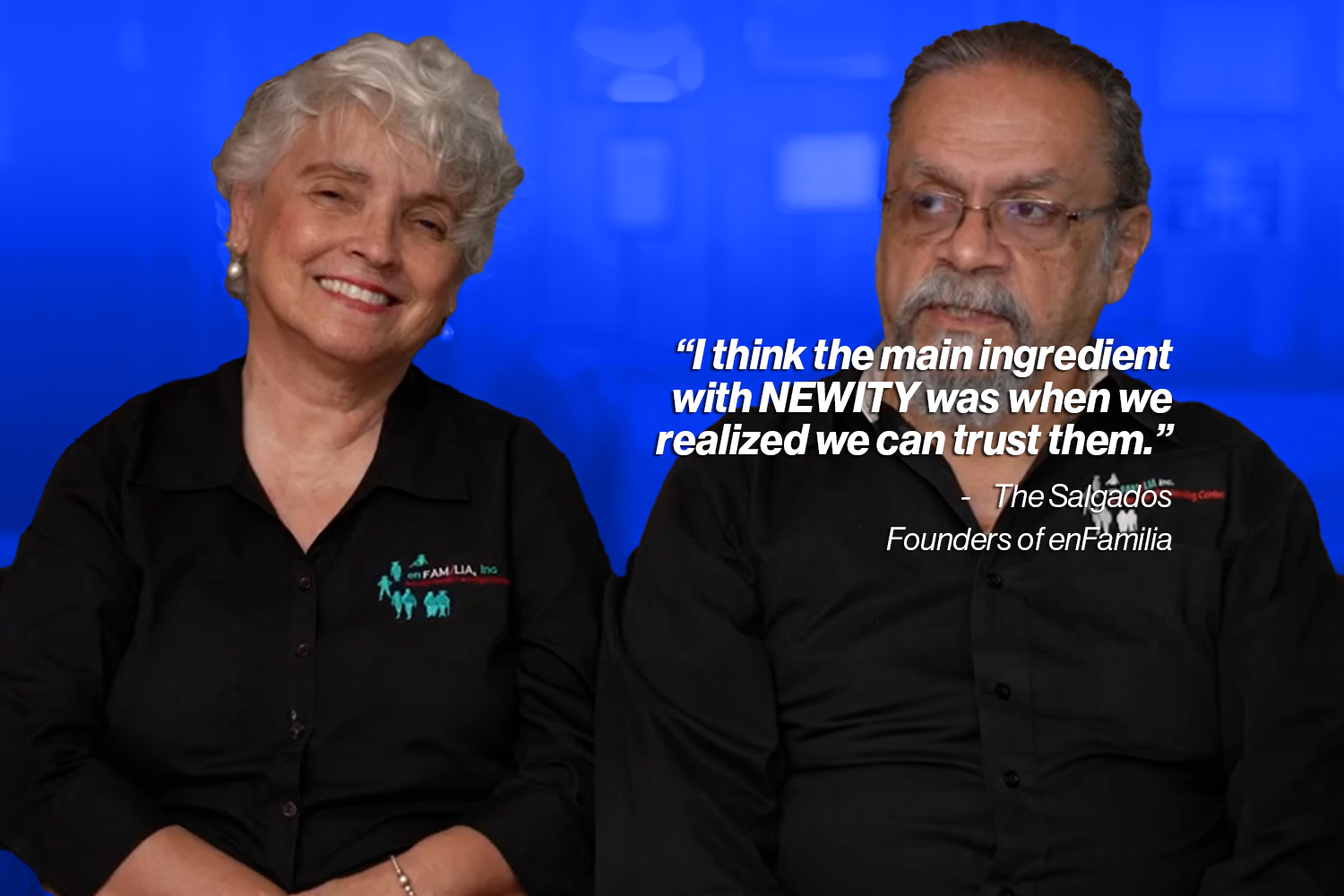

- 3.) We never make promises we can’t keep. You can review our member stories throughout the loan application process to witness firsthand how we’ve assisted fellow small business owners, just like you, in obtaining funding.

- 4.) We do not ask for upfront fees. You won’t need to pay anything until you accept a loan offer.

- 5.) We are transparent with our loan terms from the start and always match you with the best loan option for your business. We will never recommend a loan with higher interest rates and fees for our own gain. If you have any questions or need guidance at any point during the loan application process, we are always here to help.

Through NEWITY, you can apply for an SBA 7(a) loan for up to $500,000. Our streamlined loan application is easy, only requiring 3 documents, and takes less than 10 minutes to complete.