Did you receive one of the 3.9 million COVID-19 Economic Disaster Recovery Loans (“EIDL”)? If you received a portion of the $380 billion issued through the Small Business Administration’s (“SBA”) COVID-19 EIDL program, there are three things you need to know.

EIDL is a true loan and may be past due or coming due

Unlike the SBA’s Paycheck Protection Program (“PPP”), EIDL cannot be forgiven. EIDLs are loans with 30-year terms and interest rates ranging from 2.75% – 3.75%. If you received a COVID-19 EIDL in 2020, 2021, or 2022, you benefitted from the SBA’s installment of a 30-month payment deferral date. This deferral period provides loan holders with 30 months until they need to start making payments on their loan. The deferral period starts the date loan holders received their EIDL and ends 30 months from that date.

If you received your COVID-19 EIDL prior to 2022, your loan may be in default. If you received your EIDL in late 2022, your payment deferral period is coming to an end, as shown in the graphic below.

The SBA may not continuously remind you to make a payment on your EIDL

In April 2022, the SBA elected to cease active collection activities on EIDLs with an outstanding balance of $100,000 or less. While the SBA intends to provide past due notices and demand letters, there may not be additional outreach or notice that your EIDL payment is due.

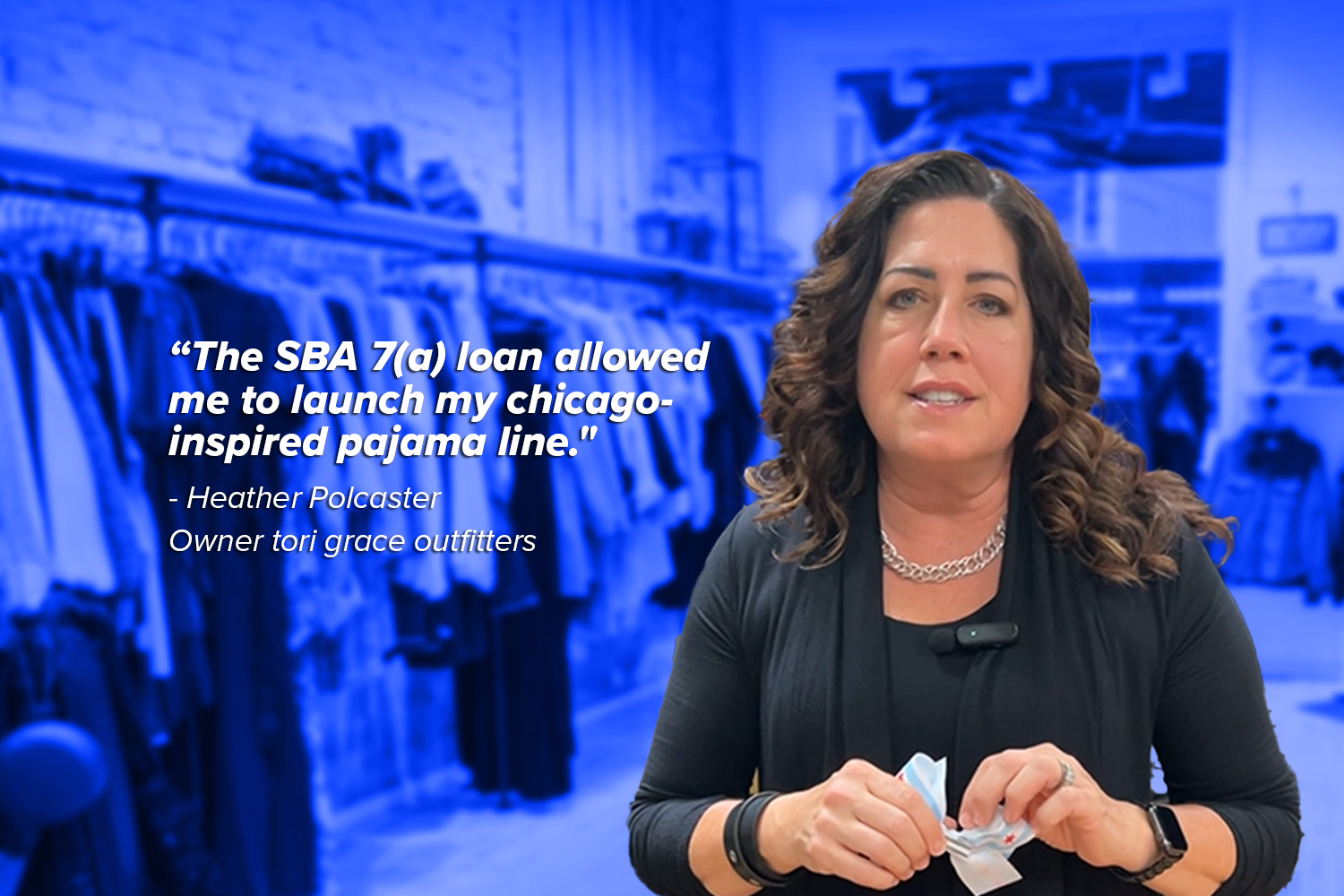

While it may sound appealing to forgo repayment of your EIDL, non-repayment of your EIDL loan will prohibit you from receiving federal aid in the future. This federal aid could be in the form of government-backed loans like SBA loans such as 7(a), 504, microloans as well as USDA loans or EIDL programs for location-specific physical disasters like the recent wildfires in Hawaii or Hurricane Idalia in Florida.

If your loan is greater than $100,000, the SBA may take additional methods to collect on your EIDL if it is past due. This could include taking possession of collateral or working with the Treasury Department to garnish wages or initiate other collection activities.

Take action now, whether or not your loan is due

As part of the 30-month deferment period, the SBA allows businesses to make voluntary payments without prepayment penalty. While your interest continues to accrue over the 30-months and non-payment over the 30-months will result in a balloon payment at time of maturity, you can take action whether your loan is past due or coming due soon.

For Past Due Loans

Create or access the MySBA Loan Portal to make payments.

If you are not able to make payments, contact COVID-19 EIDL Customer Service at 833-853-5683 from 8am until 8pm ET Monday through Friday or email [email protected].

For Loans Not Yet Due

Create or access the MySBA Loan Portal to monitor your loan status, make single payments, or establish recurring payments.

If you are concerned that you may not be able to make payments when your loan becomes due, consider applying for the Hardship Accommodation Plan.

The Hardship Accommodation Plan allows eligible borrowers to make reduced payments for a six-month period with an option to renew after the plan concludes. Interest will continue to accrue under this plan, which may increase or create a balloon payment at the end of the loan term. Note, businesses can enroll in the Hardship Accommodation Plan beginning 60 calendar days before their first payment is due.

To learn more about the Hardship Accommodation Plan, please visit the SBA’s COVID-19 EIDL webpage.

As a small business owner it can be difficult to keep up with the latest developments and changes. Stay informed by becoming a NEWITY member. You’ll receive weekly emails, updates, and insights like this EIDL article directly in your inbox.