For businesses that made it through the coronavirus pandemic and the subsequent economic downturn, the current moment represents an exciting opportunity to bounce back and grow. We are experiencing another dip in the economy, but small businesses can use this time to strategically expand in 2023 and beyond.

As companies search for growth opportunities, they will need to evaluate their financing needs. The popular Paycheck Protection Program (PPP) came to a close in 2021, so entrepreneurs must look elsewhere for access to capital. One of the best options is the Small Business Administration’s 7(a) loan program.

What are SBA 7(a) loans?

The Small Business Administration (SBA) 7(a) loan program is the SBA’s most widely used small business loan product. SBA 7(a) loans are issued by SBA-certified lenders and partially backed by the SBA.

It’s also worth noting that the SBA 7(a) loan program is always operating; it’s not built for a specific crisis like PPP. This means small business owners can access capital through SBA 7(a) at any time to fuel growth or aid the company through a difficult period.

Features of SBA 7(a) loans that position small businesses for growth

SBA 7(a) loans have some key features that make the program favorable for entrepreneurs looking to grow their business.

1) Versatility

One of the reasons the SBA 7(a) loan program is so popular is its versatility. SBA 7(a) working capital loans up to $500,000 can be used to cover a wide variety of expenses:

- Payroll

- Operating expenses

- Rent

- Utilities

- And more

The versatility of the loans is beneficial for small businesses who may need help covering expenses in one or several of these categories.

2) Terms that enable better cash flow

SBA 7(a) loans also have terms that enable better cash flow – a key for any growing business. The program typically allows for little to no down payment, longer loan terms, and lower interest rates compared to conventional financing options. This lessens the burden on the company’s cash flow and makes monthly payments more affordable.

3) Interest rate

As mentioned above, the interest rate on SBA 7(a) loans is typically better than many forms of traditional financing, meaning the business owner pays less: both on a monthly basis and overall. This additional cash can be reinvested in the growth of the business. The rates vary by lender, but SBA 7(a) loans through NEWITY have an interest rate of WSJ Prime + 2.75%.

4) SBA guaranty

Another feature of SBA 7(a) loans that can help business grow is the SBA guaranty percentage. The SBA guarantees a specified portion of each 7(a) loan, helping lenders to mitigate risk so more businesses can qualify for funding. This guaranty can make SBA 7(a) loans easier to obtain than conventional loans, so any size businesses can grow, even if they might usually struggle to access capital.

Why small businesses should explore the SBA 7(a) loan program now

Some aspects of the SBA 7(a) loan program shift year-to-year as the SBA accounts for economic conditions and other factors. Other parts of the program are especially beneficial in times of economic hardship.

In addition to the features listed above, the following 7(a) loan specifics for fiscal year 2023 are favorable for entrepreneurs:

- For loans under $500,000, there are still no upfront fees from the SBA.

- The SBA has plans to adjust programs to “encourage more investment in

disadvantaged businesses as well as growing startups.” - As PPP is no longer an option, the number of businesses seeking and obtaining

SBA 7(a) loans will continue to increase– and SMBs can apply in under 30 minutes with NEWITY.

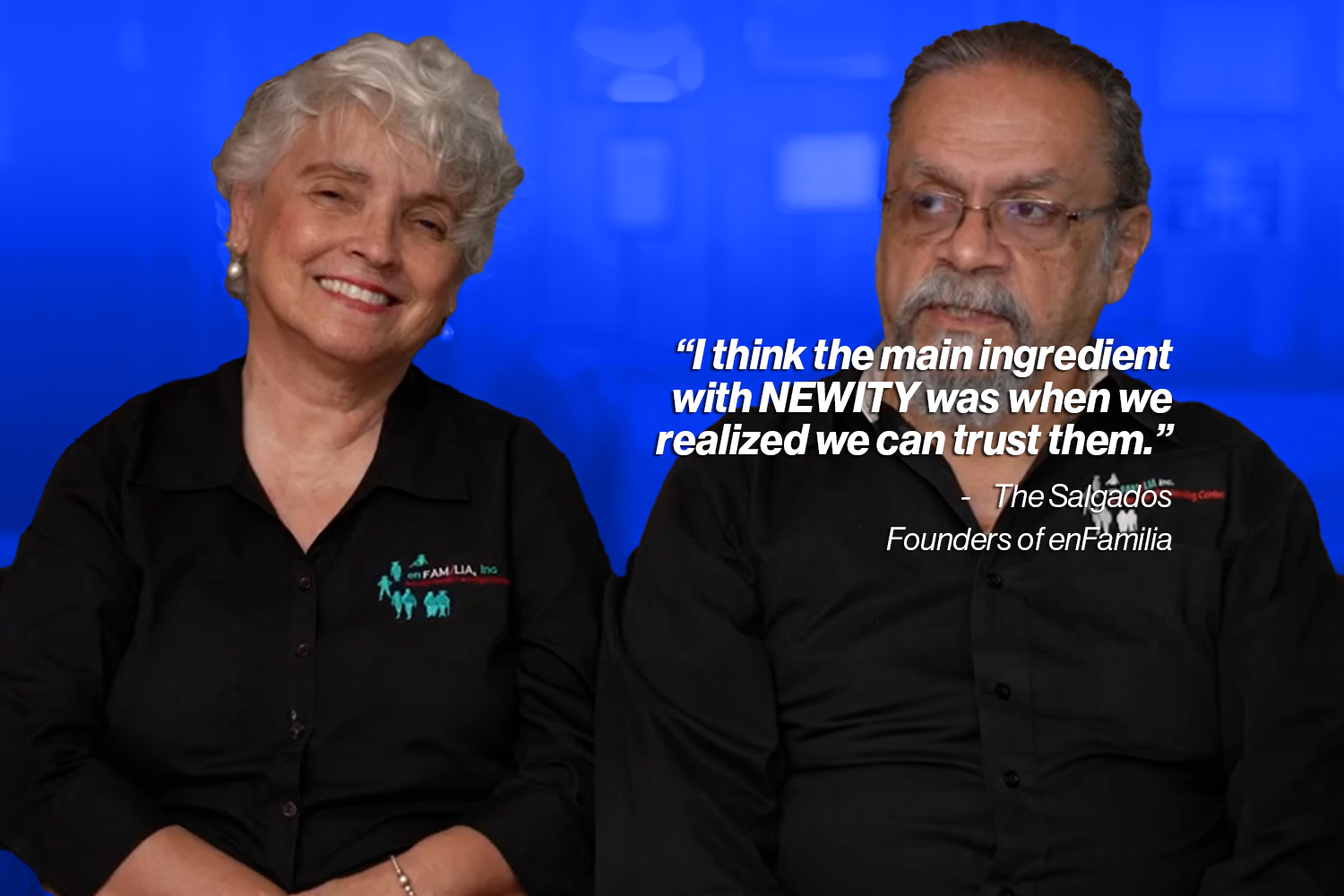

Applying for a SBA 7(a) loan with NEWITY can ensure the application process is as fast and smooth as possible, while also securing favorable terms. NEWITY’s loan team is with you every step of the way and you can stay updated on your application status in the member portal.

As we move out of the pandemic and into the new normal, savvy small business owners can capitalize on this moment and grow during economic uncertainty. Entrepreneurs who find the right financing support to support their future growth will be in a better position for 2023 and beyond.