Before you start

1. Navigate to Forgiveness

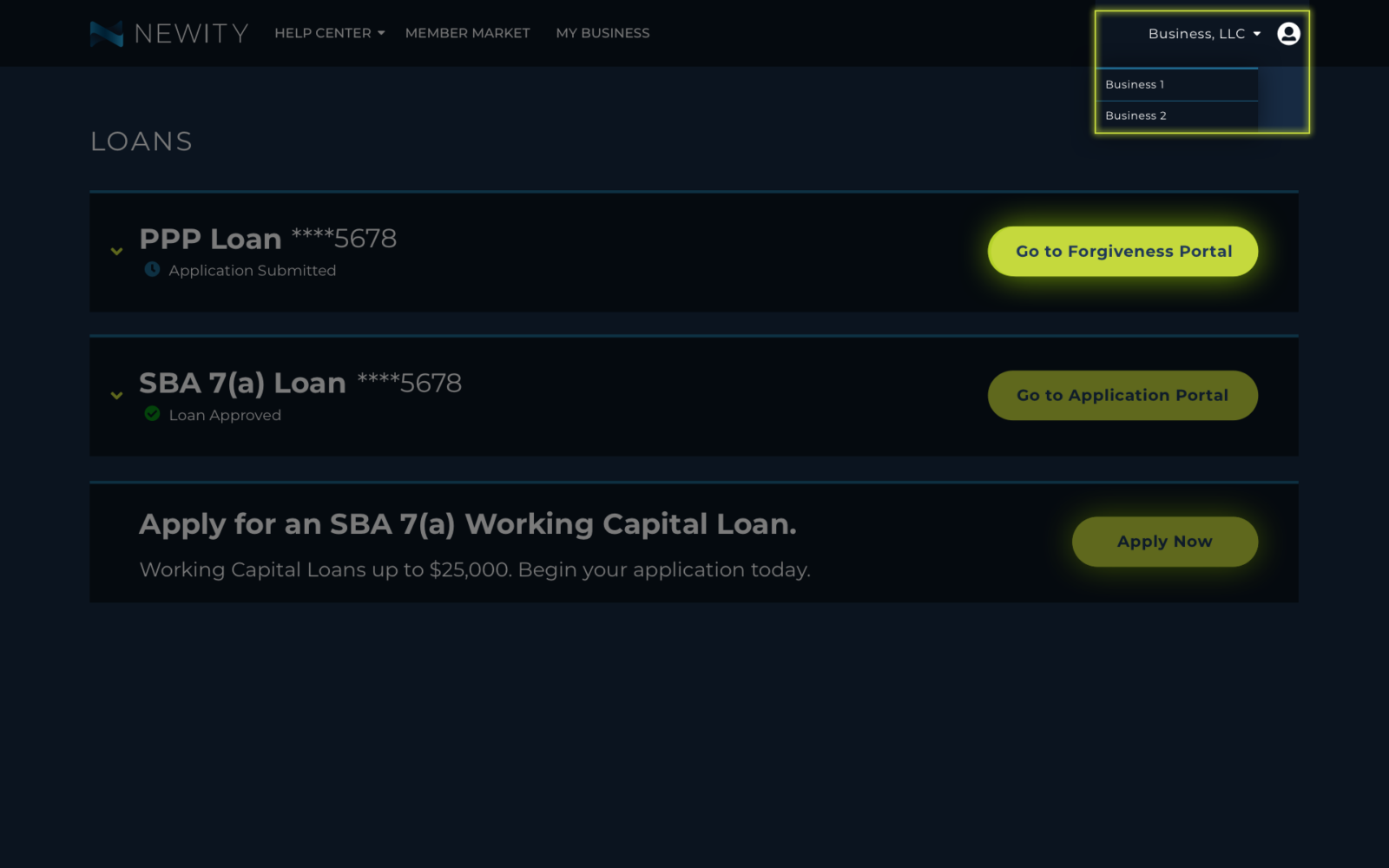

Within the dashboard, simply select the business you’d like to begin your PPP forgiveness application for.

Navigate to the correct loan and select the <strong>Go to Forgiveness Portal</strong> button.

2. Enter Your PPP Loan Information

Complete the form by entering the information of your forgiveness request, matching details to your final loan application. Continue by clicking the next arrow.

3. Enter Your Business Information

Enter the information for your business and click the next arrow.

4. Connect Your Data Sources – Optional

You have the option to connect directly to your business accounts, for easier calculation of your forgiveness application. Click the next arrow to continue.

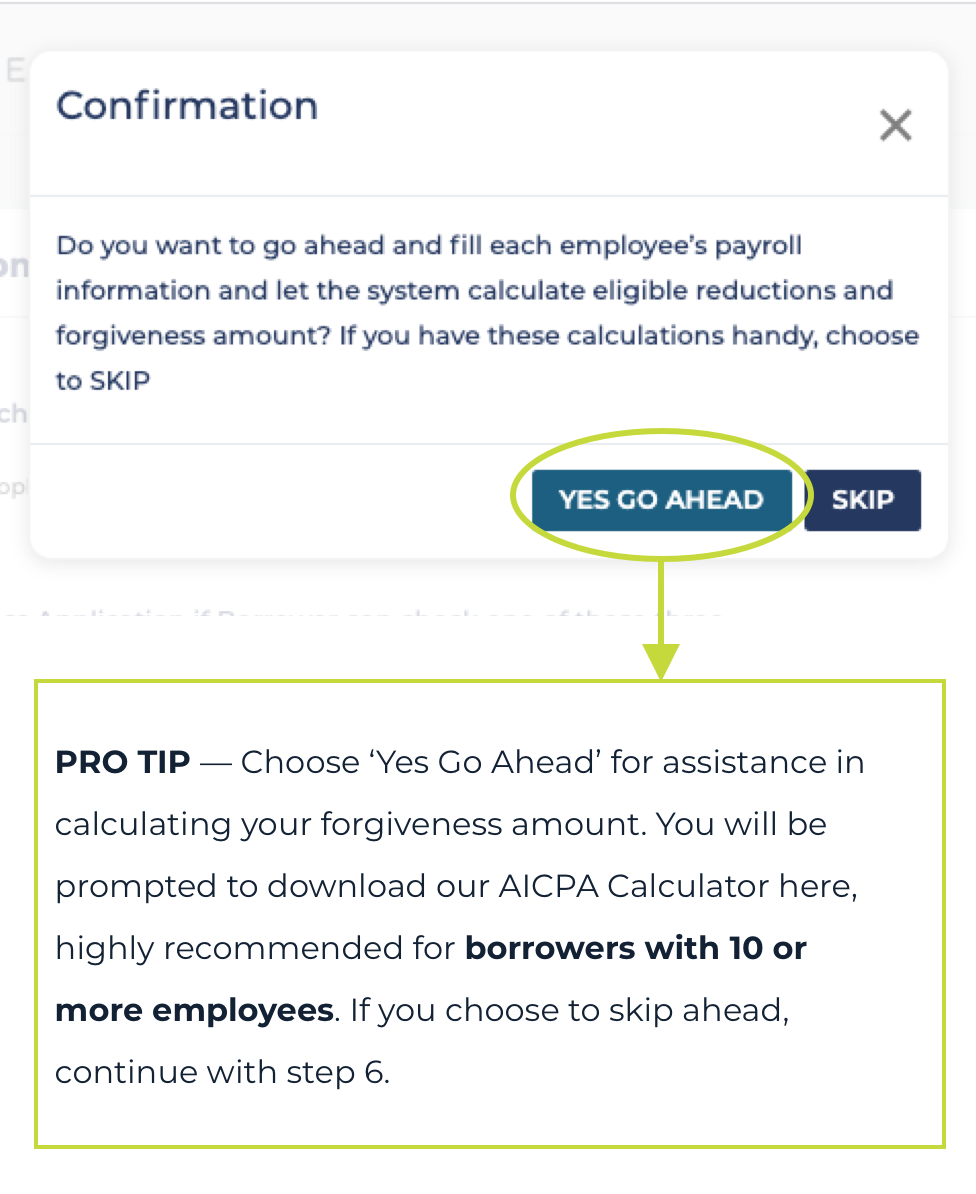

In the absence of a CARES payroll report from a third-party payroll provider, it is recommended that borrowers complete the AICPA Calculator.

5. Enter Payroll Information

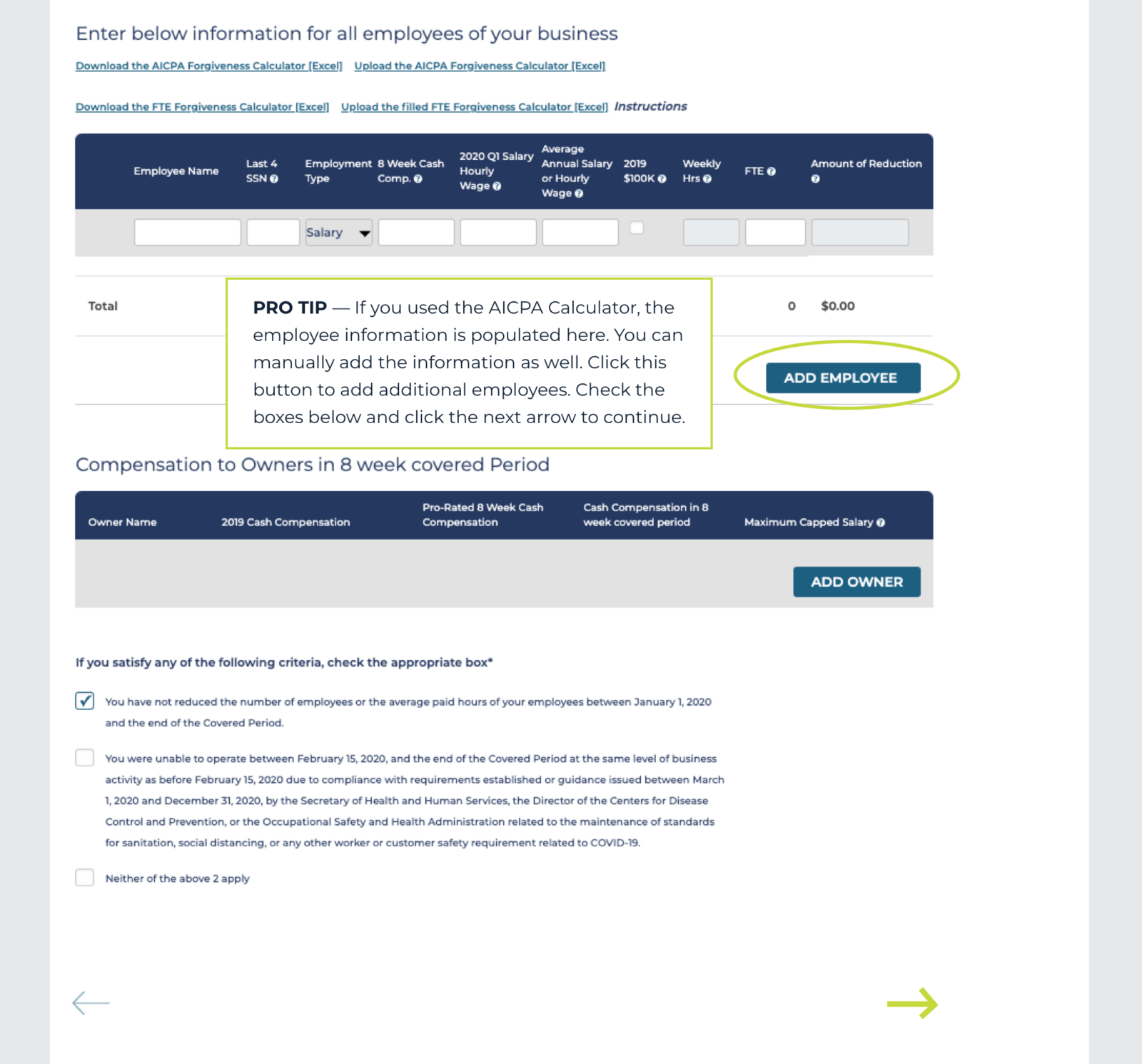

Please review the Form 3508 Standard Instructions for expanded guidance, definitions and eligibility instructions for borrowers.

In the absence of a CARES payroll report from a third-party payroll provider, it is recommended that borrowers complete the AICPA Calculator.

If you decide to use the calculator later, you may return to this step.

6. Calculate PPP Forgiveness

Open the AICPA Forgiveness Calculator on your computer. If the calculator does not open to the Instructions tab, follow these instructions below. Read through carefully. Note that as you work through the spreadsheet, BLUE cells are where you will need to input your information and GREEN cells are where amounts are calculated.

8. Forgiveness Eligibility Calculations

Complete the information on this page and click the next arrow to continue.

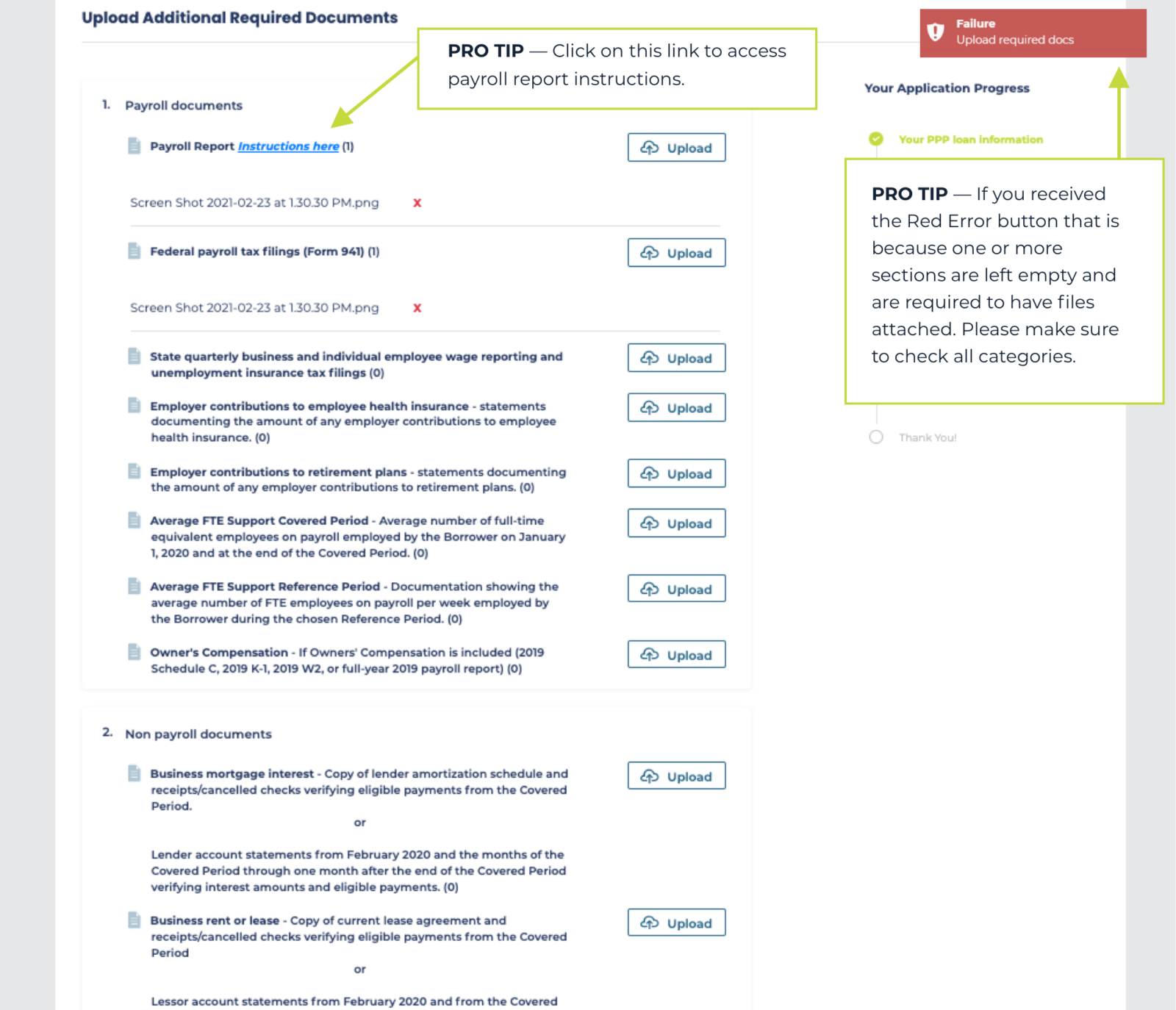

9. Upload Documents

10. Submitting

Step 3 of the upload documents page includes a button for generating your application form.

11. Confirmation

You will see a message asking you to confirm your submission. If you are ready to submit, click ok. While you will be unable to edit your application currently, you may make edits as needed during the review process and will review your final application before completing the e-sign and submitting to the SBA.

12. Understanding My Application Status