Follow the steps below to quickly prequalify for a business loan

Our loan application process is designed with your security in mind. Enjoy peace of mind knowing that your credit score will not be impacted and all of your personal information is kept secure.

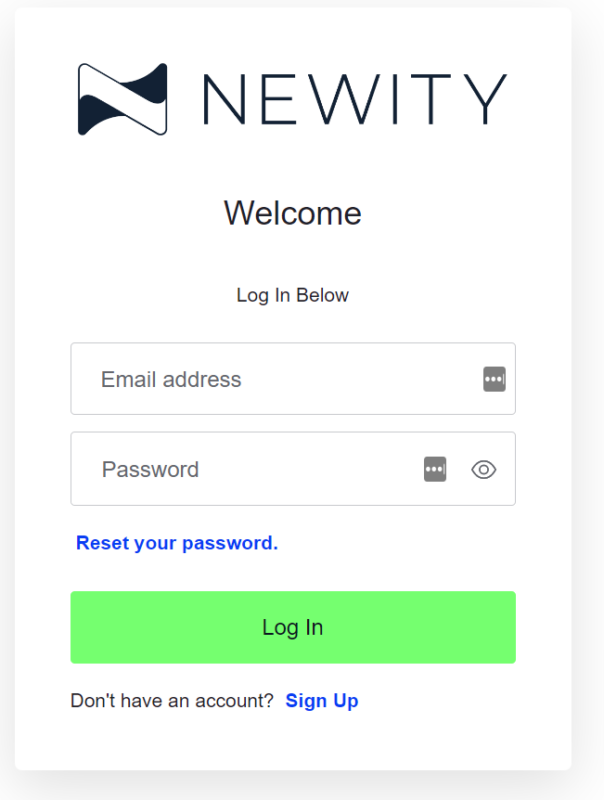

1. Set Up or Log Into Your Account

Visit portal.newitymarket.com to log in or sign up for your account.

View our Account Setup Guide here if you need any additional guidance.

FORGOT YOUR PASSWORD?

No problem, click Reset Your Password. on the login screen and an email will be sent for you to reset your password.

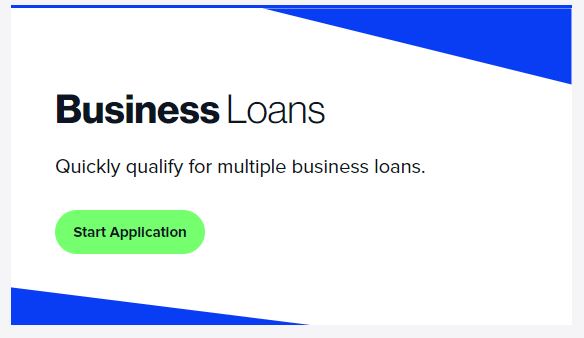

2. Locate the Business Loans tile in the Portal

Once you are logged into your account, locate the Business Loans tile in the portal and click Start Application.

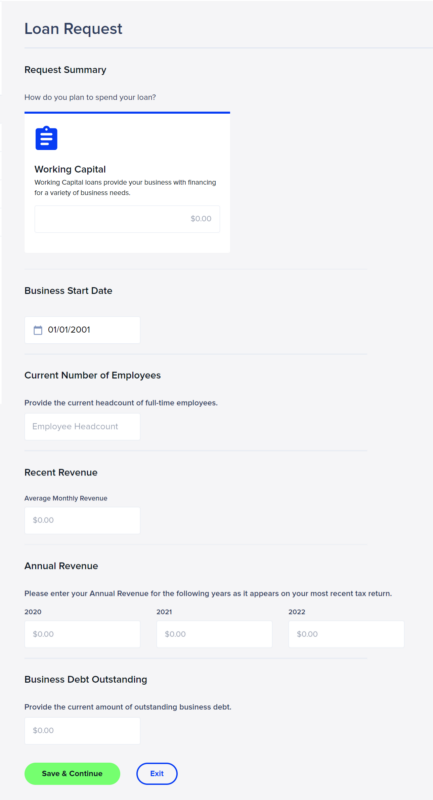

3. Loan Request

The first screen is the Loan Request portion. Please enter your desired loan amount in the Working Capital tile. In the revenue section, enter your average monthly revenue followed by your annual revenue as it appears on your business’ tax records for 2020, 2021, and 2022.

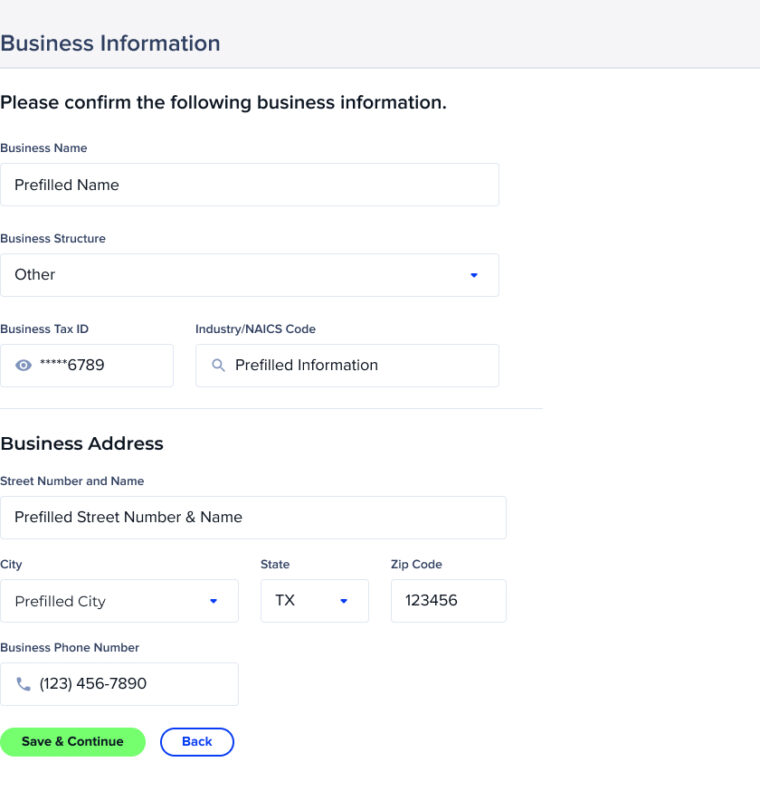

4. Business Information

On the Business Information section, enter the details as they appear on your business’ tax records.

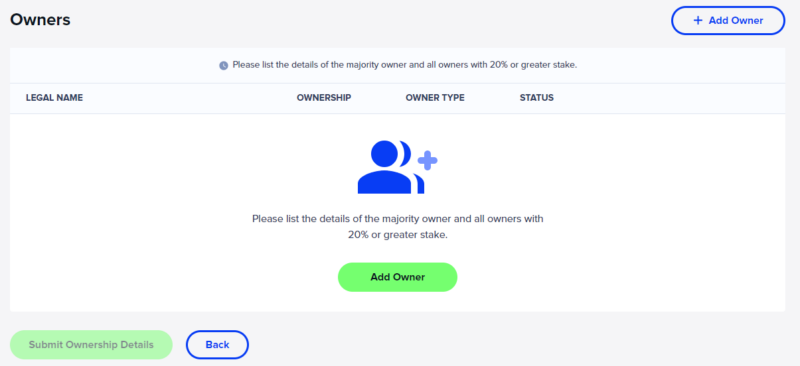

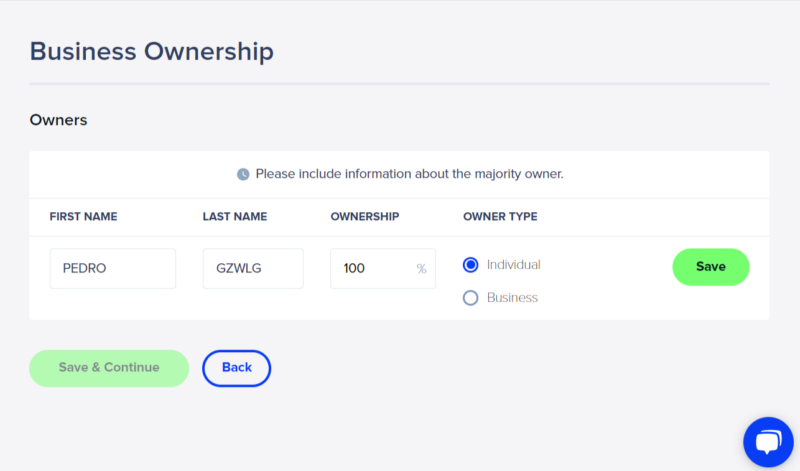

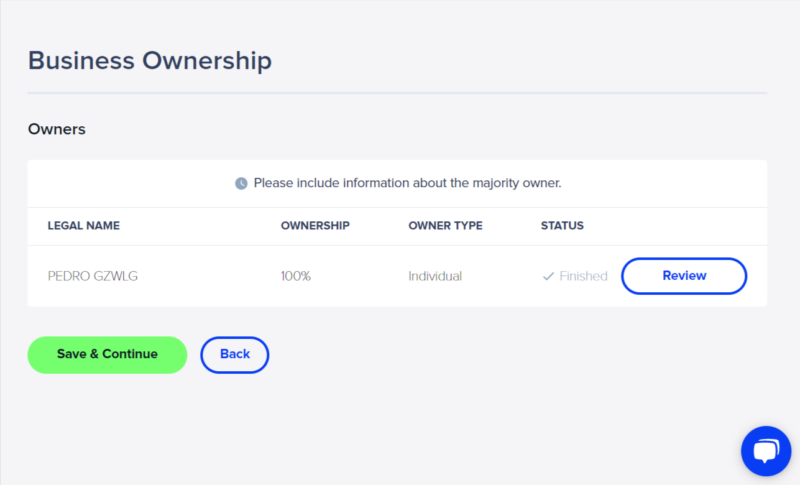

5. Business Owner

Note: Only the majority owner’s information is needed to prequalify.

After selecting ‘Add Owner,’ fields will appear to enter the first name, last name, and ownership percentage of the owner. Be sure to select the type of owner before clicking ‘Save.’

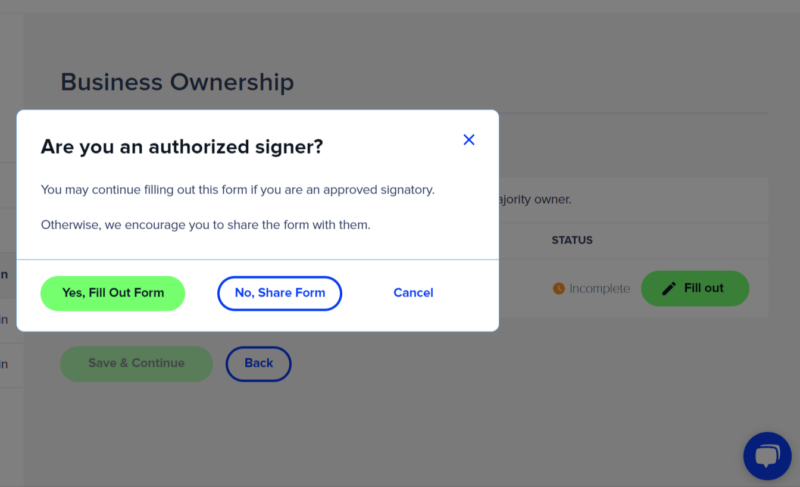

If you are not the owner and/or do not know the pertinent information to complete the ownership form, it can also be shared with the contact via email by selecting ‘No, Share Form.’ If you are able to complete the ownership form, click ‘Yes, Fill Out Form’ to continue.

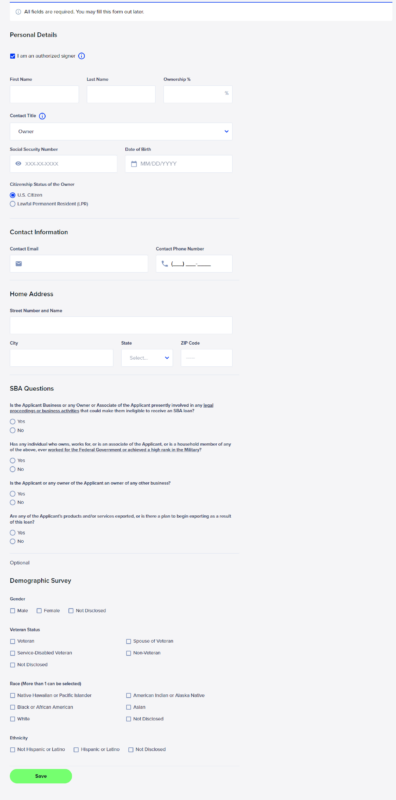

Be sure to click the ‘I am an authorized signer’ box at the top of the Personal Details screen.

Once you have entered all requested information, press ‘Save.’ This will return you to the Business Ownership screen so you can continue your application.

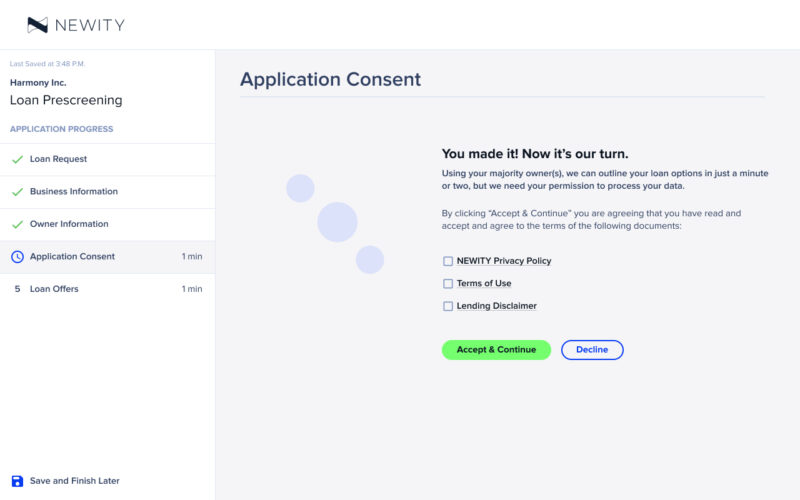

6. Application Consent

In the Application Consent section, please read and accept the Terms of Use, Privacy Policy, and Terms of Application by clicking each box before selecting ‘Accept & Continue.’

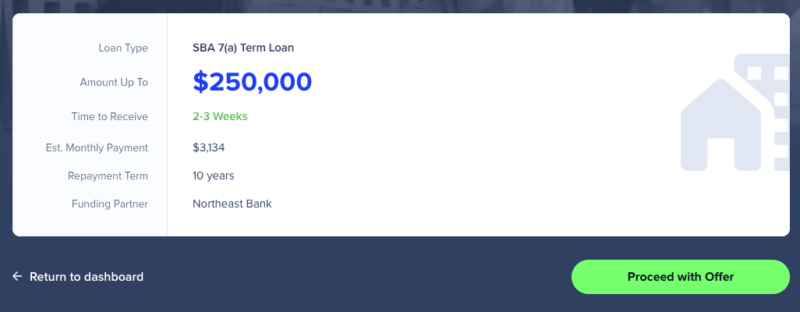

7. Loan Offers

In the Loan Offers section, you will be presented with a loan that fits your company profile. To learn more about each loan offer, click the header that corresponds to your screen.

To move forward with your 7(a) loan option, click ‘Proceed with Selected Offer.’ This will notify a NEWITY representative to reach out to you via email.

In the interim, NEWITY welcomes you to learn more about the Employee Retention Credit (ERC) program, also offered in the NEWITY portal.

Unfortunately, NEWITY is not able to provide an SBA 7(a) loan offer, but NEWITY’s partner has an alternative loan offering for your consideration. To move forward with our partner’s offer, click ‘Select and Continue’ to continue your loan journey.

NEWITY also welcomes you to learn more about the Employee Retention Credit (ERC) program, also offered in the NEWITY portal.

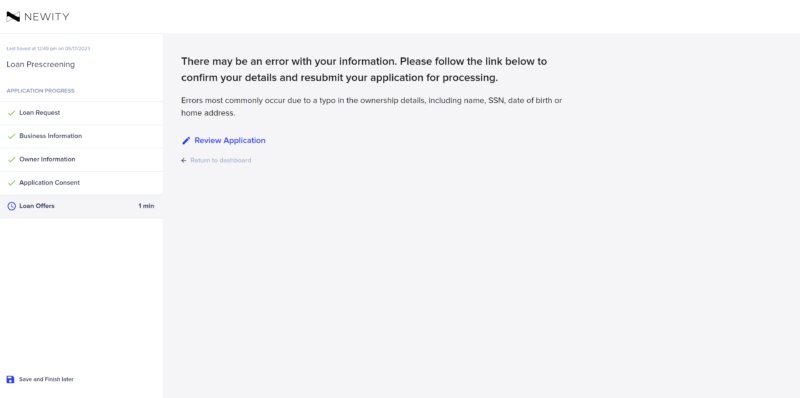

If you see this screen, NEWITY was unable to determine an immediate loan offer for your consideration or there might have been an error. A NEWITY representative will reach out to you with next steps.

In the interim, NEWITY welcomes you to learn more about the Employee Retention Credit (ERC) program, also offered in the NEWITY portal.