You had a business idea.

You executed your idea and turned it into a business. Now, that business is growing, and to capitalize on your strategy you may find that your existing capital structure – whether it be personal savings, outside investment, or retained earnings – are not sufficient or not the prudent choice to take your business to the next level.

What financing options do you have?

An internet search might lead to online vendors that promise “fast capital with no credit check required!” or “PO financing that lets you keep ownership of what you’ve built!” Too often, these options lead down a rabbit hole of expensive money that can cripple your business at the very moment it was ready to take off.

The Challenge — Access to affordable, reliable financing.

Even with a history of strong operations and good credit, many small business owners find that they do not fit the credit standards of traditional banks – even those that claim to partner with entrepreneurs and smaller enterprises. Repeatedly, small business owners find that banks are uninterested or unable to provide small-balance loans to cover basic operating expenses like inventory purchases, a new marketing initiative, payroll, or just keeping up with utility bills while cash is deployed to revenue-generating projects.

Discouraged, many business owners turn to the financing sources that seem to be the only ones available in the marketplace – short-term working capital loans that come with terms in the fine print that are borderline predatory. These lenders offer loans well into the six figures, enticing customers with the promise of quick approval and fast funding in as little as a few days. But a closer look at the terms reveals that the devil is in the details. The loans often have short repayment periods, usually requiring repayment in as little as 12 months. The interest rate is often well above 10%, tracking closer to expensive credit cards than loans originated through true partnership between you and your lender. Some may even require a payment draw directly from your account on a weekly basis. While the cash up front was easy to obtain, keeping up with debt service creates serious cash flow constraints at a time when flexibility of capital is paramount.

So, where can you turn for a break?

Recognizing the critical role of small business in the American economy, the United States Government created the Small Business Administration (SBA) in the post-World War II era. The SBA’s mandate is simple – to help Americans start, build, and grow businesses. One flagship pillar of this mission is achieved by providing access to the affordable capital that small business owners have for decades struggled to obtain.

The SBA’s 7(a) loan program is designed to facilitate flow of funds to America’s smallest businesses by providing a government-guaranteed loan product. The SBA does not provide loans directly, but rather offers a partial guarantee to qualified lenders in the event a borrower is unable to make loan payments and defaults on the loan. This lowers the risk profile of a credit, which can be the difference between a lender making the loan and passing on it in favor of larger, more established, less risky business customers.

To participate in the 7(a) program, lenders must meet stringent requirements that include caps on interest rates and fees. In fact, it is illegal for lenders to charge any additional fees to a borrower under the 7(a) program beyond minimal passing of expenses that cover the cost of originating a loan. This means the cost of capital to your business is transparent.

What are the typical loan terms?

SBA 7(a) loans vary based on the loan size, uses of funds (what you’d like to spend the money on), and term of the loan. In most cases, SBA loans carry variable interest rates that are tied to a base rate, such as WSJ Prime. The Prime rate does not fluctuate often, and typically changes to interest rates take place every calendar quarter (if there has been a fluctuation in the base rate).

Typical terms for a small-balance 7(a) working capital loan

Loan Amount – Up to $500,000

Interest Rate – 8-10%

Repayment Term – 10 years

Payments Due – Monthly

Allowable uses of funds – Working capital, which includes payroll, marketing expenses, utilities, inventory purchases, and other general operating expenses.

What does the process look like?

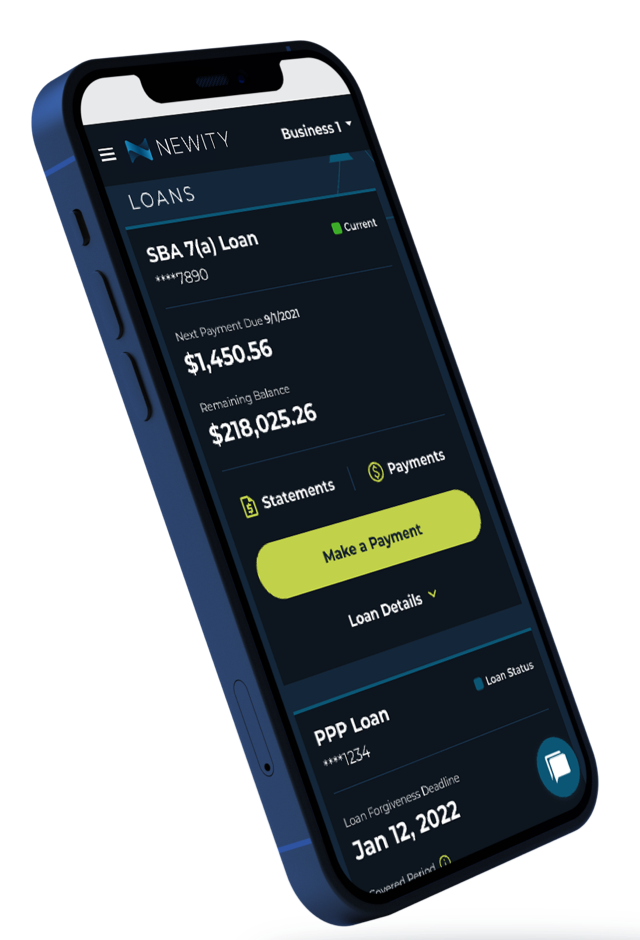

Only approved SBA lenders can participate in the 7(a) program; so, the first step is to get matched with a lender. NEWITY, in partnership with Northeast Bank, offers small balance 7(a) working capital loans up to $500,000 through a simple, online application. Our smart portal provides a step-by-step flow for confirming your business’s SBA eligibility, providing the required information and supporting documentation, and communicating with our relationship management team to answer any questions you have as you work through the process.

While a non-SBA working capital loan can fund very quickly, SBA loans have a more thorough approval process. The NEWITY team works with you at your speed. Once your application is complete, we can provide a loan decision the same day – and funding in as little as 10 business days. A few extra days is well worth the wait when your debt service savings compared to traditional short-term capital lenders is in the thousands.

Accessing capital to fuel your business should not depend on your size, or whether you are personal friends with the CEO of your commercial bank. Connect with NEWITY to see how a 7(a) working capital loan can be a gamechanger for your business.

Connect with NEWITY to see how a 7(a) working

capital loan can be a gamechanger for your business.