If you have affiliates, follow the steps below to save time and avoid delays in processing your SBA 7(a) loan application.

If any guarantors (i.e., owners of 20% or more of the applicant business) hold 50% or more ownership of any other business, the affiliate business(es) must be disclosed on your SBA 7(a) loan application.

Owner Details & Affiliates:

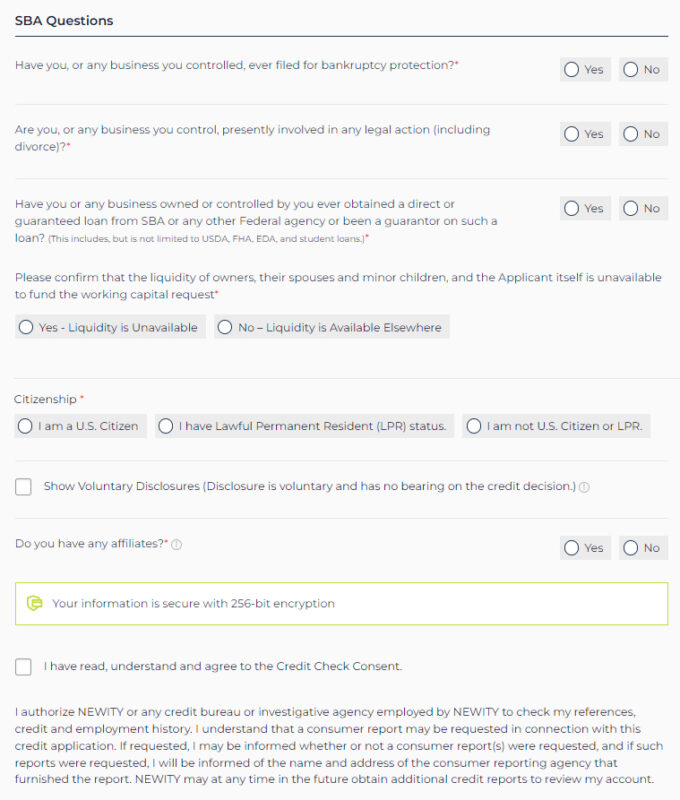

As noted above, if any guarantors (i.e., owners of 20% or more of the applicant business) hold 50% or more ownership of any other business, please select Yes to the affiliates question on the Owner Details screen. You will be able to input the affiliate business’ information and answer simple questions about the capital requirements of that business on the next screen.

If you indicate Yes to the primary guarantor (primary owner) having affiliates on the Owner Details screen, the next screen will be the Affiliate Information section.

Pro Tip: If you have additional guarantors of your applicant business and they hold 50% or more ownership of any other business, the additional guarantors will have the opportunity to disclose their affiliate business(es) when they receive the email from [email protected] to confirm their ownership details of the applicant business. To learn more about additional owners, please visit our Additional Owners Guide.

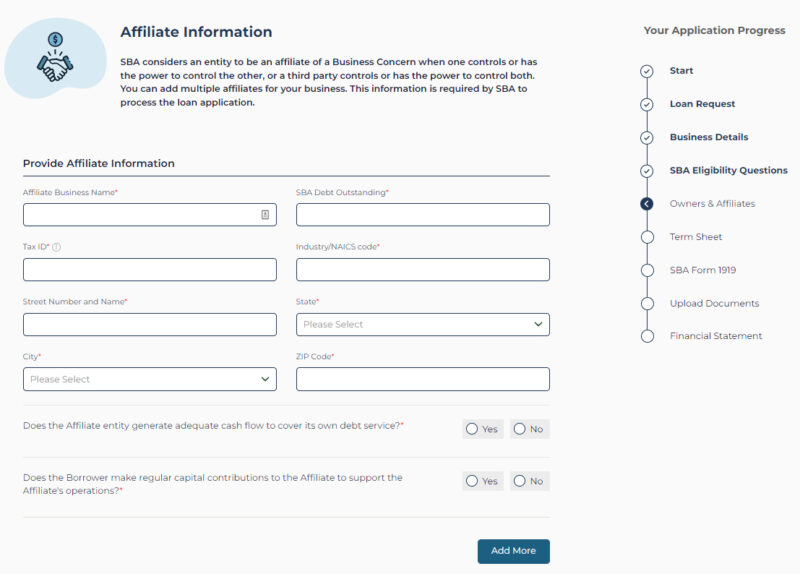

Affiliates:

Please enter your business information here as it appears on your affiliate business’ tax records and answer the few simple questions about the capital requirements of that business.

- In the Affiliate Business Name field, enter the Full Legal Name of your affiliate business exactly as it appears on your affiliate business formation document. Depending on your business structure, this will be filed Articles of Organization, filed Articles of Incorporation, Certificate of Formation, or Certificate of Organization.

- Pro Tip: If you operate your affiliate business under a DBA or Trade Name, enter the Full Legal DBA or Trade Name of your affiliate business exactly as it appears on the Fictitious Name Certificate (DBA or Trade Name) in the Affiliate Business Name field. If the state your business operates in does not require registration of a Fictitious Name and you are unable to provide a Fictitious Name Certificate for your affiliate business, please enter the Full Legal DBA or Trade Name of your affiliate business as it appears on your affiliate business’ tax records.

- If the affiliate business has any SBA debt outstanding, please enter the current dollar amount of the outstanding debt in the SBA Debt Outstanding field. If the affiliate business does not have any SBA debt outstanding, please enter “0” in the SBA Debt Outstanding field.

- Pro Tip: If you operate your affiliate business under a DBA or Trade Name, enter the Full Legal DBA or Trade Name of your affiliate business exactly as it appears on the Fictitious Name Certificate (DBA or Trade Name) in the Affiliate Business Name field. If the state your business operates in does not require registration of a Fictitious Name and you are unable to provide a Fictitious Name Certificate for your affiliate business, please enter the Full Legal DBA or Trade Name of your affiliate business as it appears on your affiliate business’ tax records.

- If the affiliate business has any SBA debt outstanding, please enter the current dollar amount of the outstanding debt in the SBA Debt Outstanding field. If the affiliate business does not have any SBA debt outstanding, please enter “0” in the SBA Debt Outstanding field.

- In the Tax ID field, enter the EIN of your affiliate business exactly as it appears on your IRS EIN Letter. If you do not have an EIN for your affiliate business, enter the SSN of the primary owner of the affiliate business.

- In the Industry/NAICS code field, enter the NAICS code of your affiliate business exactly as it appears on your most recent affiliate business’ tax return. The Industry/NAICS code is a six-digit number that can be found on your affiliate business’ tax records.

- If you do not know your affiliate business’ NAICS code, you can search the NAICS code listing for the closest match to your industry at www.naics.com. We also suggest reaching out to your accountant for details regarding your current NAICS code.

- Or if you need additional accounting support, please consider reaching out to our partner, Xendoo. For more information, please visit the following link: Xendoo Accounting.

- Pro Tip: Simply begin entering your current NAICS code or industry keyword in the field and a drop-down menu of available options will appear below that line for you to select. You must click on one of the available options to accept the selection and it populate in the field. If you were to just enter in your NAICS code without selecting from the available options in the drop-down menu, it will not populate in the field correctly and you will not be able to proceed to the next screen when you select the Continue button.

- In the fields relating to the affiliate business address, enter the business address exactly as it appears on your most recent affiliate business’ tax return. If your affiliate business address has changed since your most recent affiliate business tax filing, please enter your current affiliate business address.

- Pro Tip: These fields should be used for the affiliate office business address only. You will not be required to provide the project business address of the affiliate during the application. Your assigned Relationship Manager may reach out to you for clarification if you have a project business address for your affiliate business in rare circumstances once the application is submitted.

- Eligibility Check-in: To qualify for the program, SBA eligibility requires the affiliate business have a physical address. P.O. Box business addresses are not eligible for SBA financing. If you do not have a physical affiliate business address separate from your personal address, please enter your personal address in these fields.

Affiliates Capital Requirements Questions:

Be sure to completely read each question and answer to the best of your ability, as incorrect answers could affect your eligibility.

Eligibility Check-in: For SBA loan eligibility, we are required to confirm that your affiliate business is not reliant on your other businesses, and/or the applicant business to cover their debt service or support their operations.

- For the question, “Does the Affiliate entity generate adequate cash flow to cover its own debt service?”, this is asking if capital from one of your other businesses including the applicant business is required to cover the affiliate business’ debt service.

Eligibility Check-in: To qualify for the program, SBA eligibility requires the answer to this question to be Yes. If the answer to this question is No, unfortunately your applicant business is not eligible for SBA financing.

- For the question, “Does the Borrower make regular capital contributions to the Affiliate to support the Affiliate’s operations?”, this is asking if capital from one of your other businesses including the applicant business is required to support the affiliate’s operations.

Eligibility Check-in: To qualify for the program, SBA eligibility requires the answer to this question to be No. If the answer to this question is Yes, unfortunately your applicant business is not eligible for SBA financing.

Additional Affiliates:

If the primary guarantor (primary owner) has additional affiliate businesses, where they hold 50% or more ownership of that business, select the Add More button to populate more Affiliate Information sections before selecting the Continue button to navigate to the next screen.

Affiliate Documentation:

If any affiliate business is disclosed on the application for the primary guarantor (primary owner) or any additional guarantor of the applicant business, SBA eligibility requires the following documentation from the affiliate business:

- Filed Tax Returns – Full unredacted business tax returns for the last three years* preceding the date of the loan request (i.e., FY19, FY20, FY21). This will be the full Form 1040, including Schedule C or Schedule F (as applicable), Form 1065, Form 1120 or Form 1120-S depending on the business legal structure.

- Note: If your business was incorporated 1-3 years ago, please include all corresponding documents you can up to the 3 most recent years.

- Balance Sheet Statement – Reporting date must be within 90 days of the loan request date. If you do not have a Balance Sheet, review our Financial Template series to download a Balance Sheet template and watch an instructional video on how to create a Balance Sheet Statement for your affiliate business(es).

- Year-to-Date Profit & Loss Statement – Profit & Loss (“P&L”) showing year-to-date totals through the reporting date. Reporting date must be within 90 days of the loan request date. If you do not have a P&L Statement, review our Financial Template series to download a P&L template and watch an instructional video on how to create a P&L Statement for your business.

Congratulations!

You have now completed the steps to add an affiliate to your SBA 7(a) loan application.