Follow the steps below to submit your Employee Retention Credit (ERC) application.

Before you begin, choose which situation applies to your business.

I have NOT filed for ERC yet.

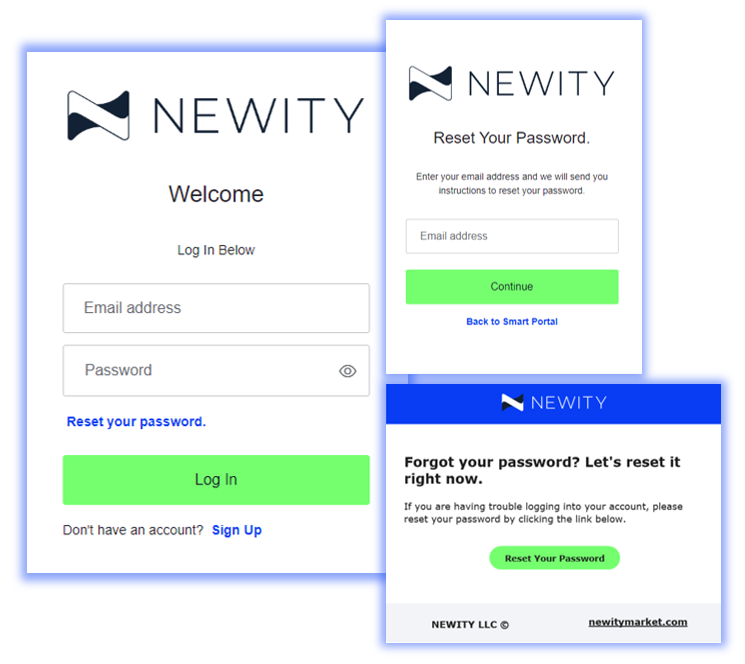

1. Sign up or log into your account.

Visit https://portal.newitymarket.com to log in or sign up for your account.

View our Account Setup Guide if you need any additional guidance.

FORGOT YOUR PASSWORD?

No problem, click ‘Reset your password’ on the login screen and an email will be sent for you to reset your password.

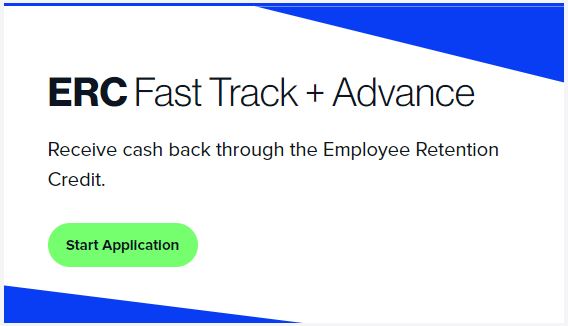

2. ERC Application - Apply Now

Navigate to the ERC tile within the Smart Portal Dashboard and click the Start Application button.

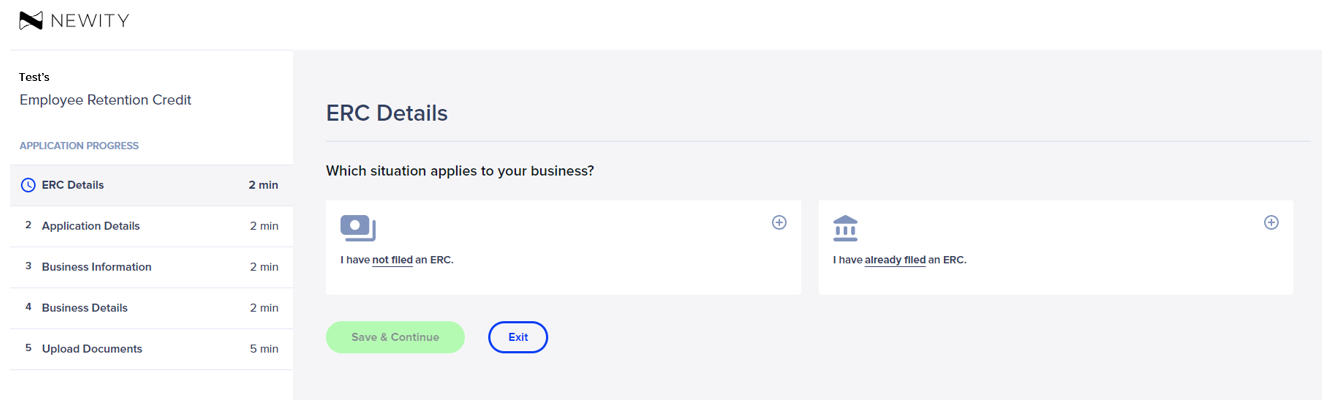

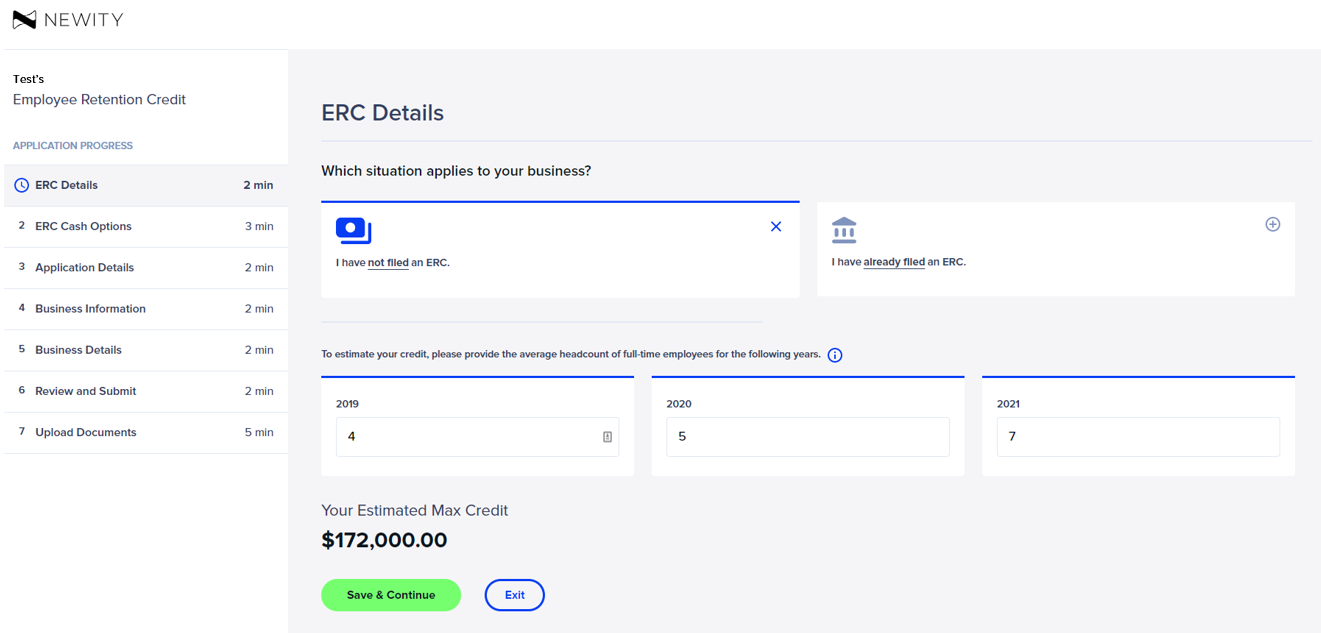

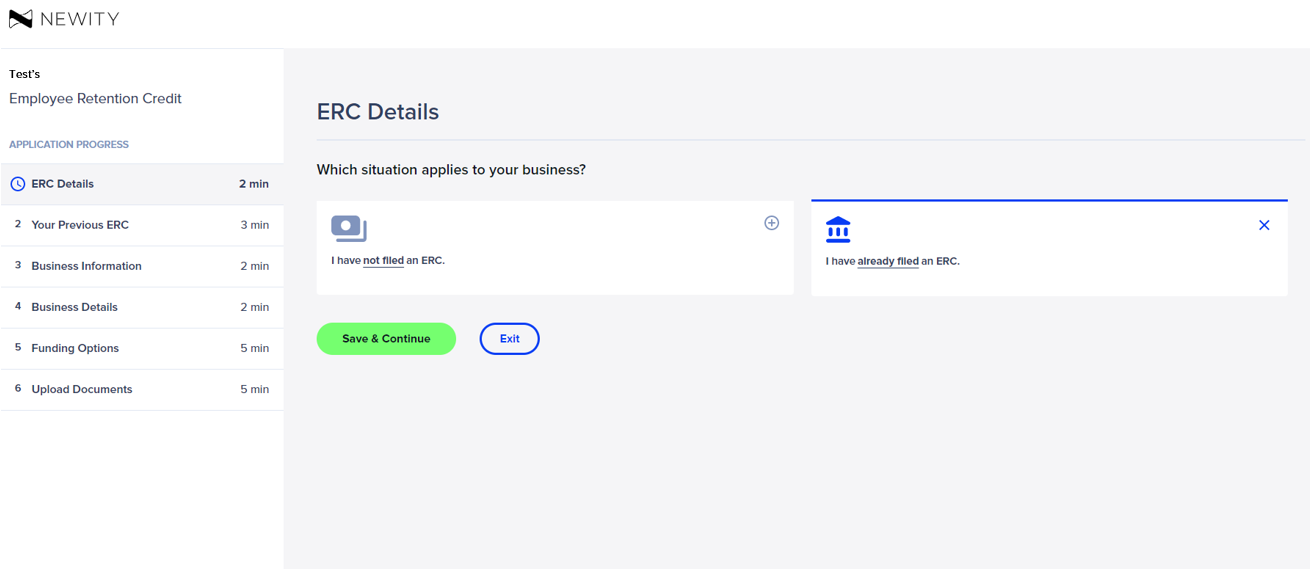

3. ERC Details

The first screen will ask whether you have or have not filed for ERC. Choose “I have not filed an ERC.”

To estimate your credit, the application will prompt you to enter the average number of full-time employees for the years 2019, 2020, and 2021. Then click “Save & Continue.”

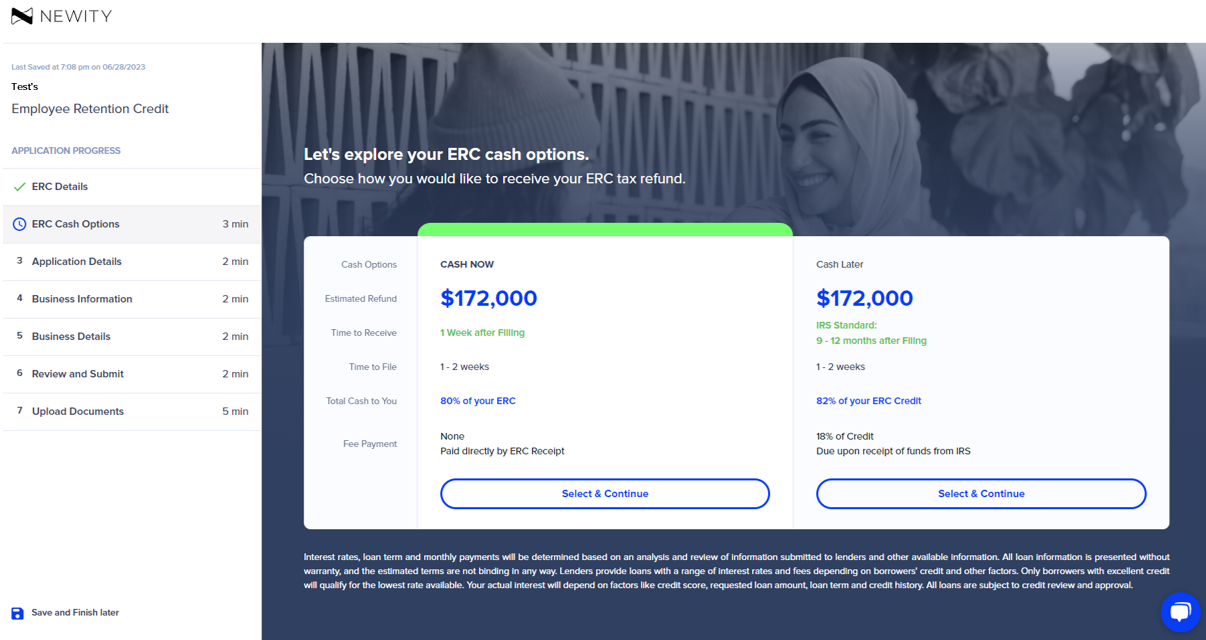

4. ERC Cash Options

On the ERC Cash Options screen, you can select an offer unique to the NEWITY Members – whether you would like to receive your ERC refund within five business days of filing through Cash Now or within 9-12 months through Cash Later.

Use the ‘Select and Continue’ button to indicate how you would like to receive your ERC tax refund, Cash Now or Cash Later.

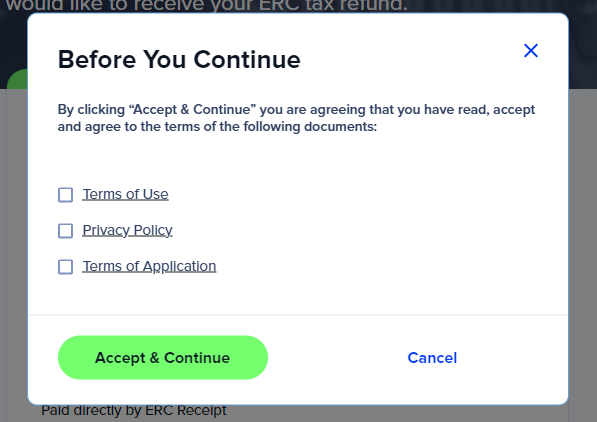

Before accepting and continuing to the next screen, please read and accept the Terms of Use, Privacy Policy, and Terms of Application by clicking all three boxes and pressing “Accept & Continue”.

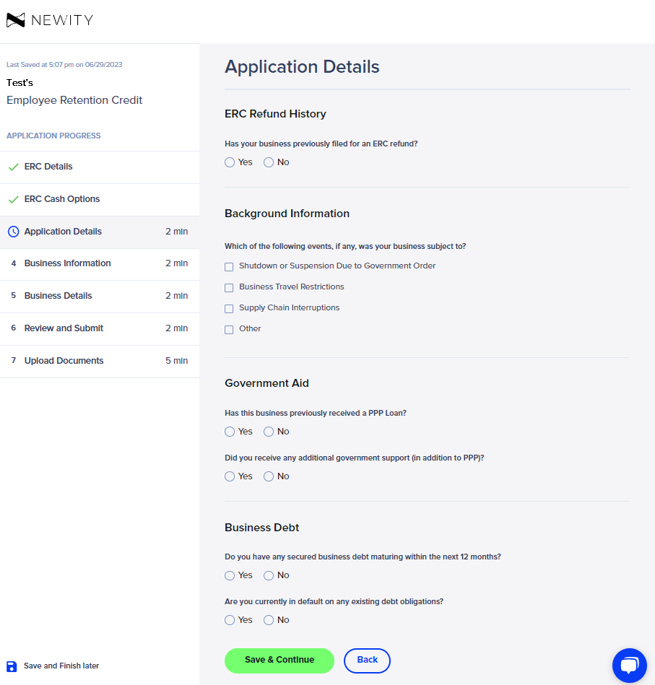

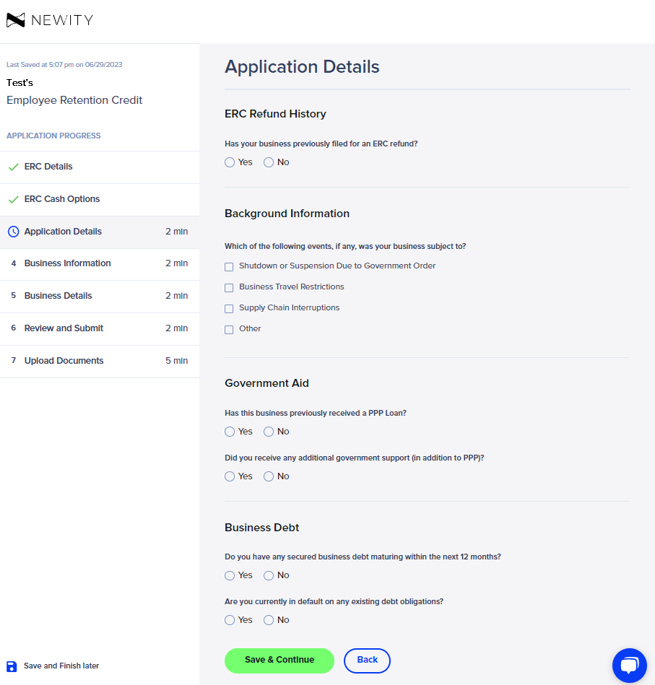

In the following Application Details screen, please confirm your ERC refund history data, background information, government aid, and business debt.

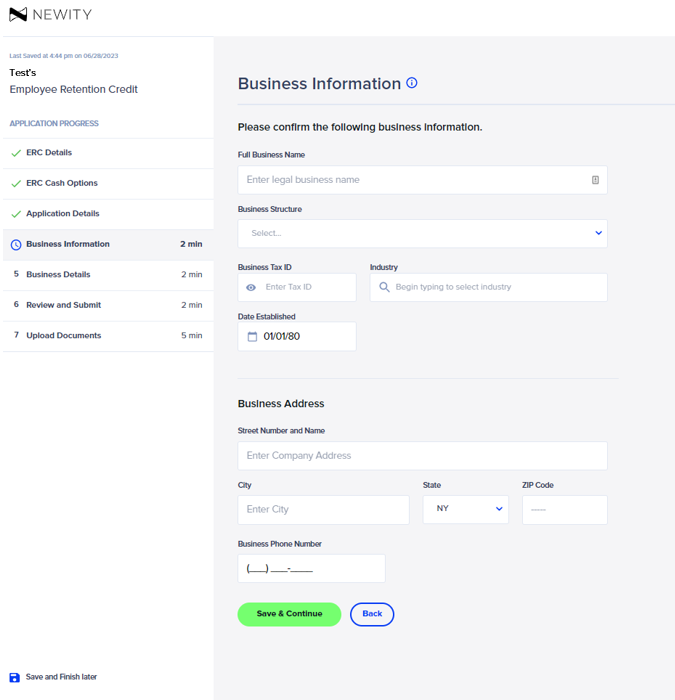

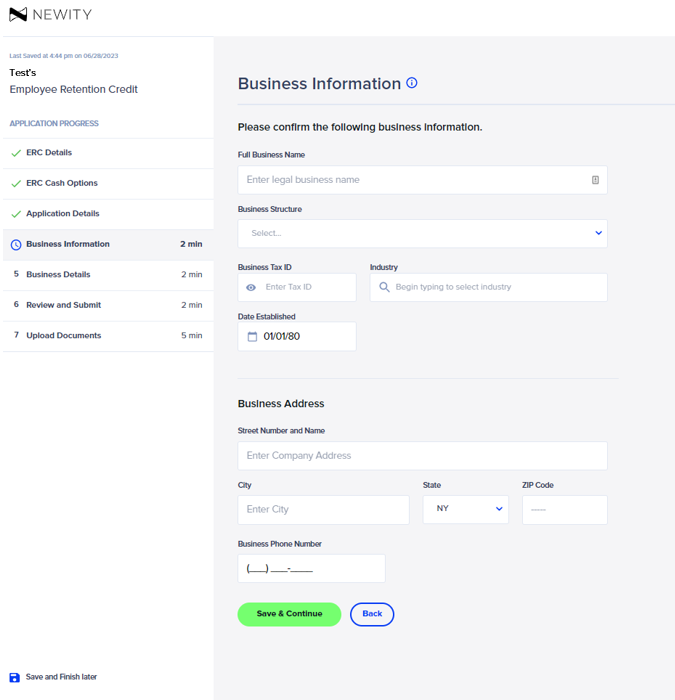

In the Business Information screen, please confirm that your business information populated correctly. If it does not appear correctly, please update it.

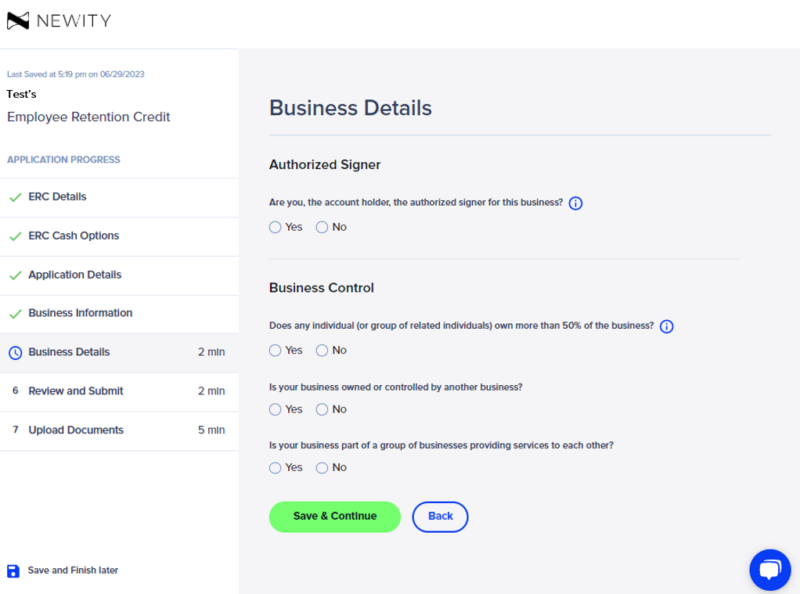

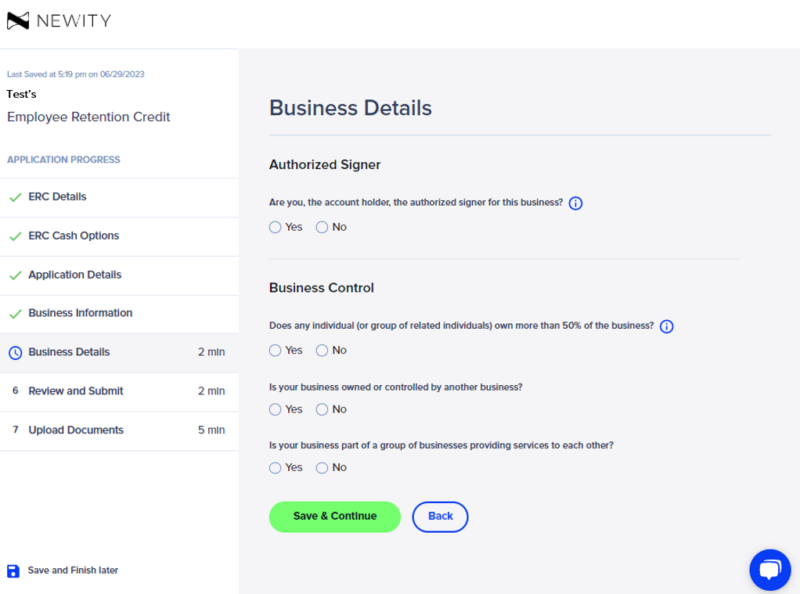

The Business Details screen captures the authorized signer and business control information. Please be sure to add any additional business owners or family members that are on the business’ payroll. If you are not the owner of the company and do not know the pertinent information for this form, it can also be shared with the contact via email by selecting “No” to the first question on this page. If you are the authorized signer for the business click “Yes” and provide the requested information. Once all information is completed, click “Save & Continue.

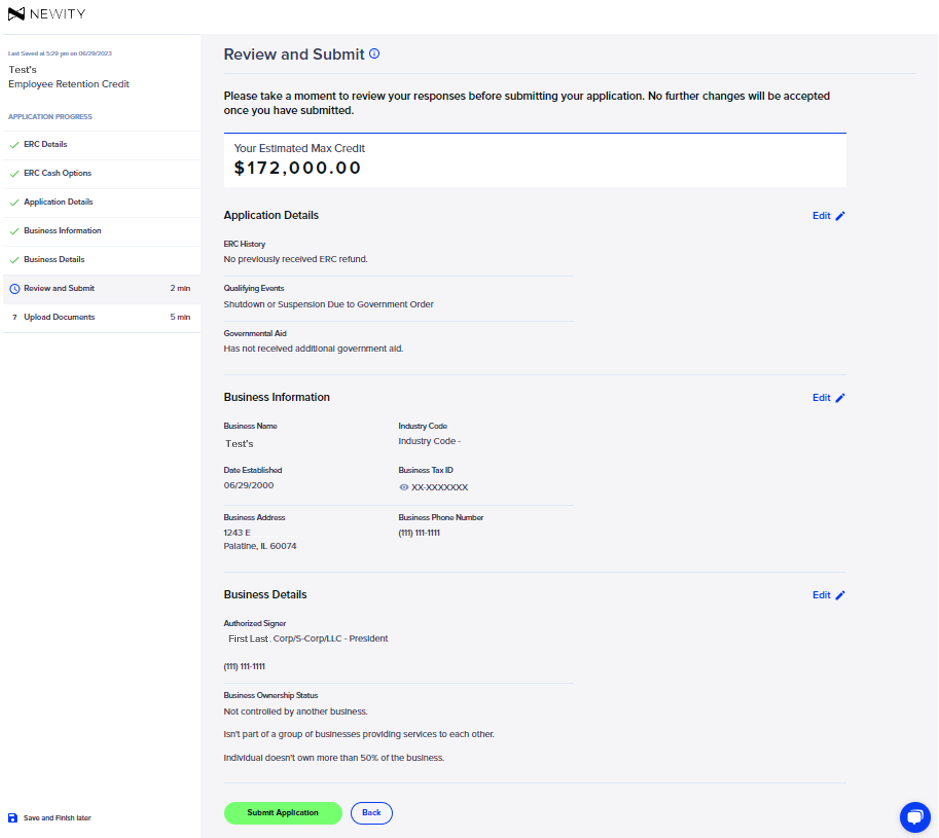

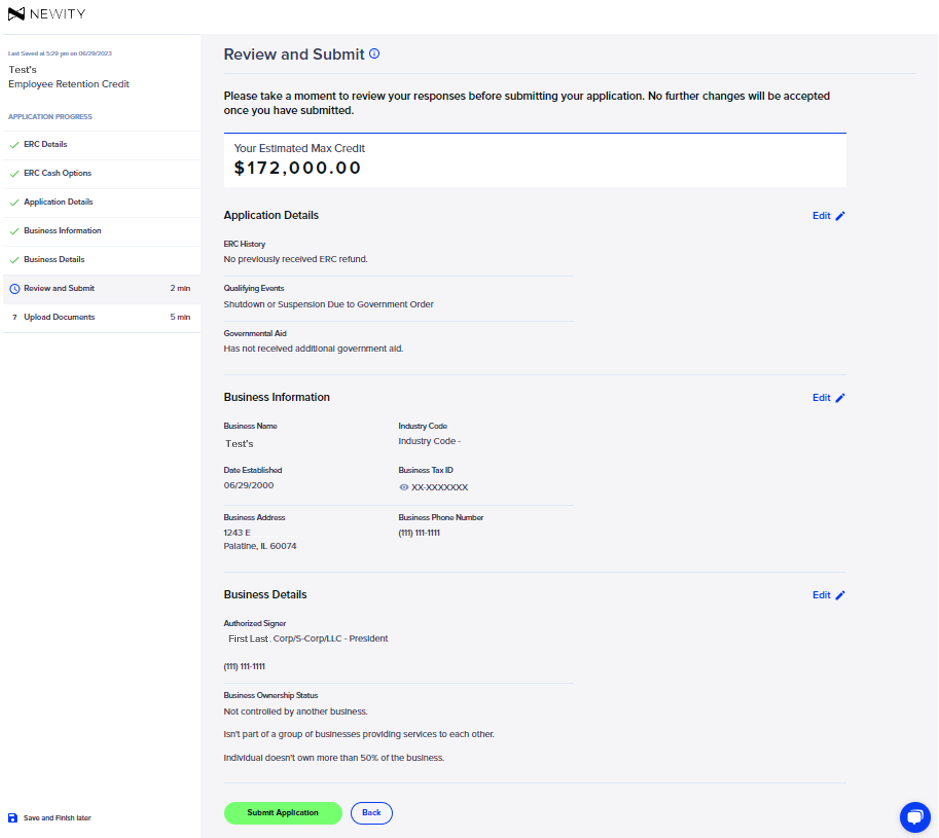

Please use the Review and Submit screen to make any last-minute changes via the edit options to the right of each subsection in your application. Once you have completed your review, select “Submit Application” to send your responses to NEWITY for review.

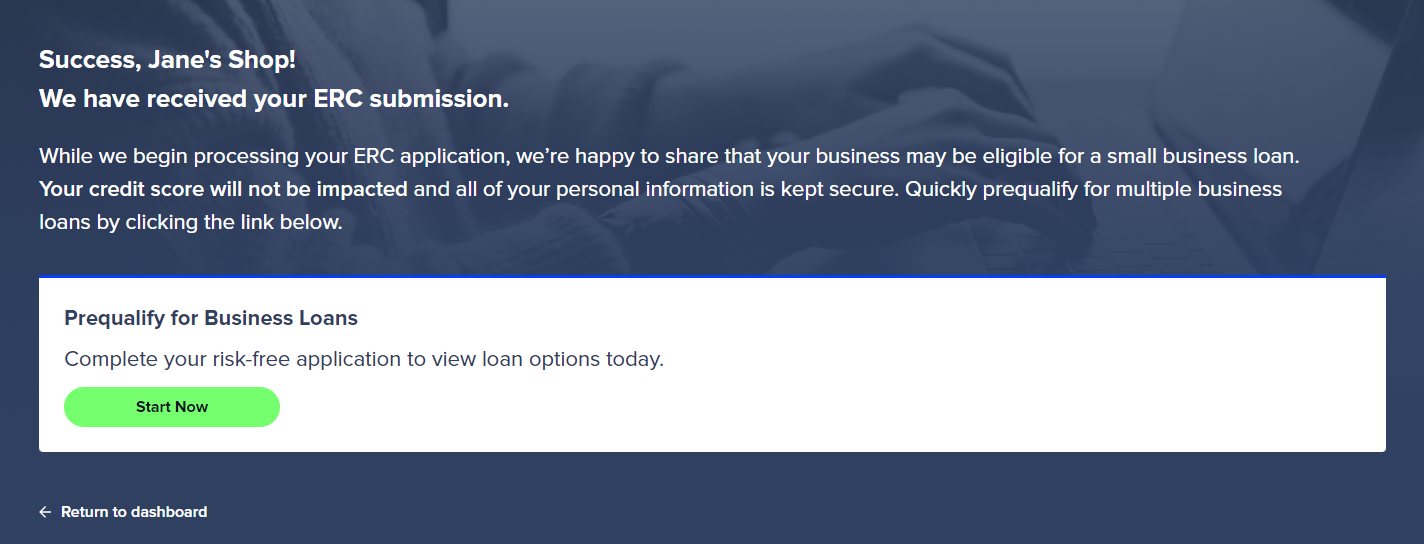

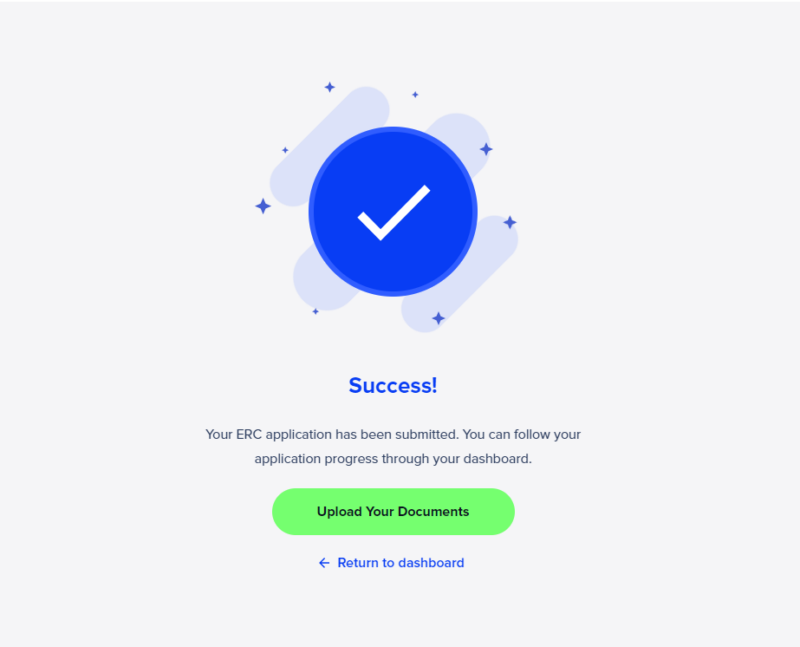

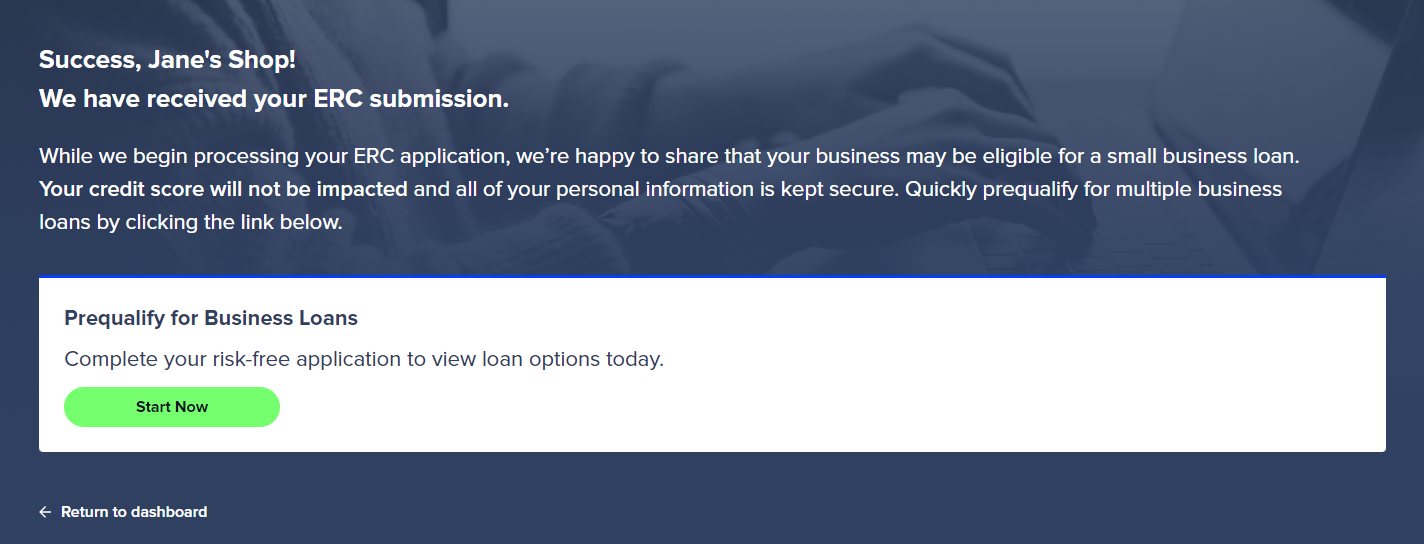

Congratulations! Your ERC application has been successfully submitted. You may return to the dashboard or begin uploading your documents.

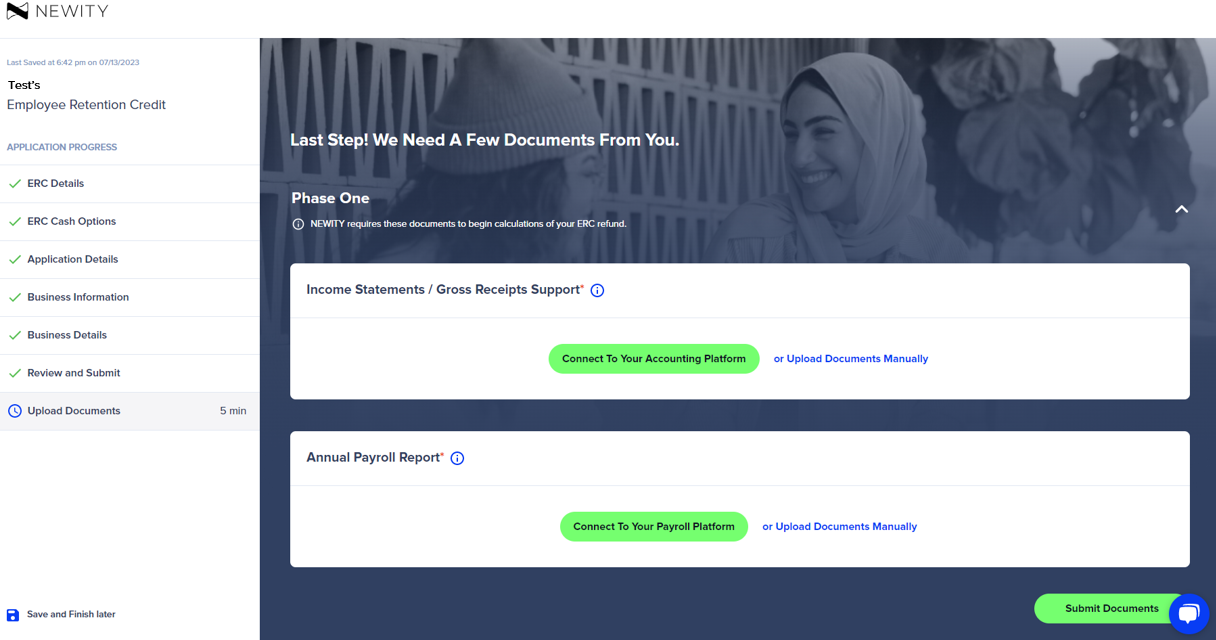

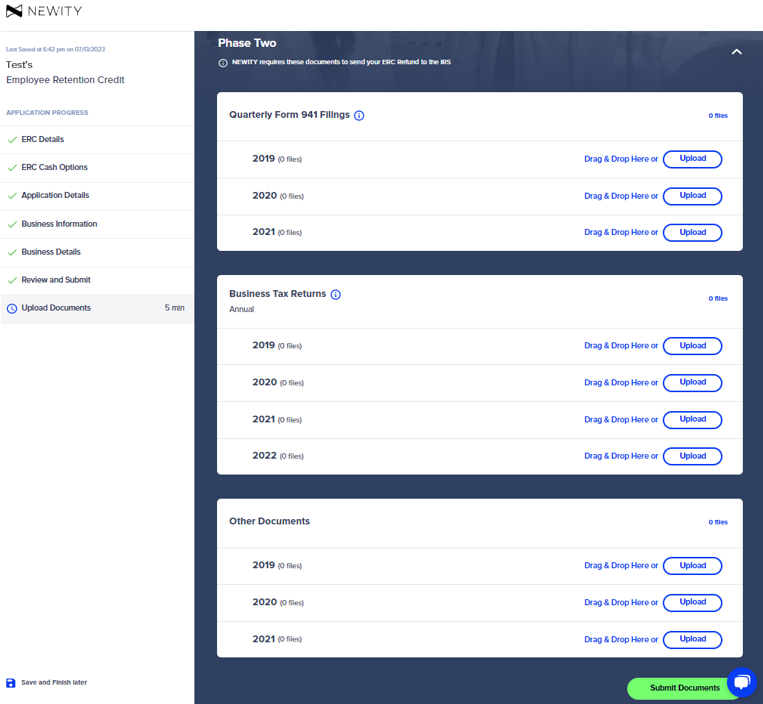

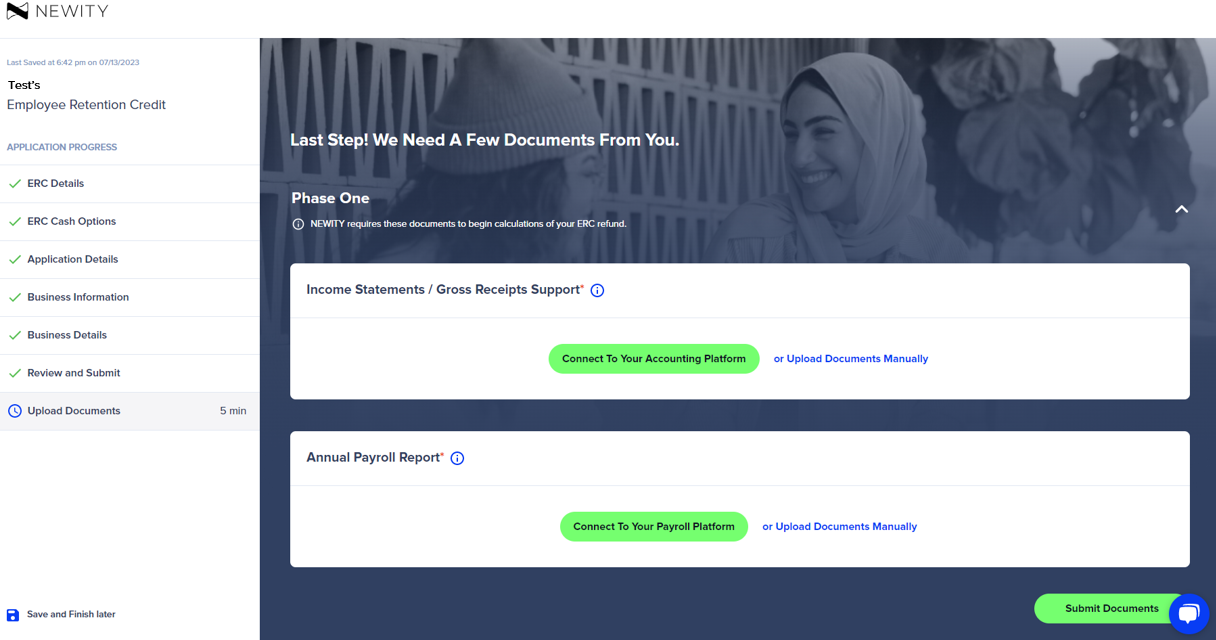

Uploading documents is the final step in the ERC Application process.

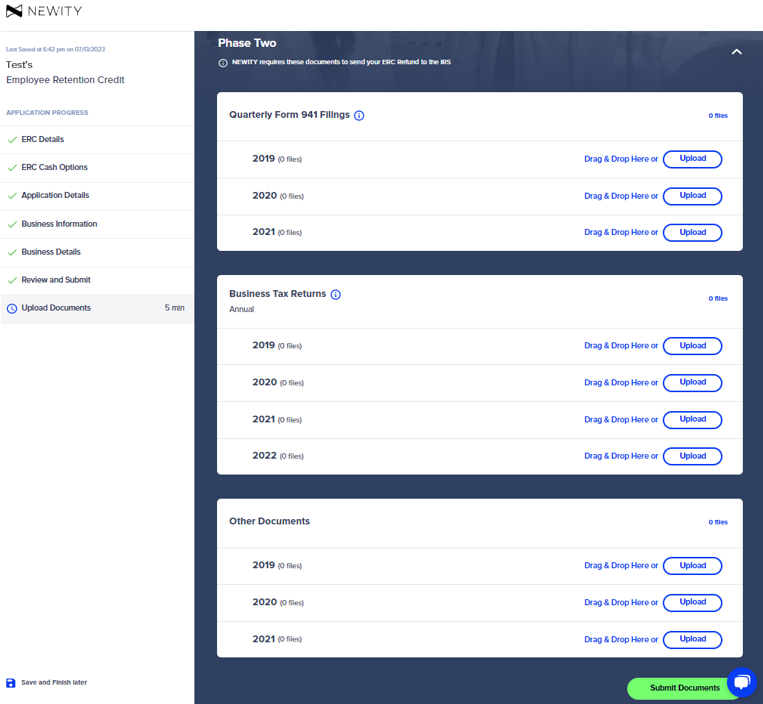

There are two main sections in the Upload Document screen – Phase One and Phase Two.

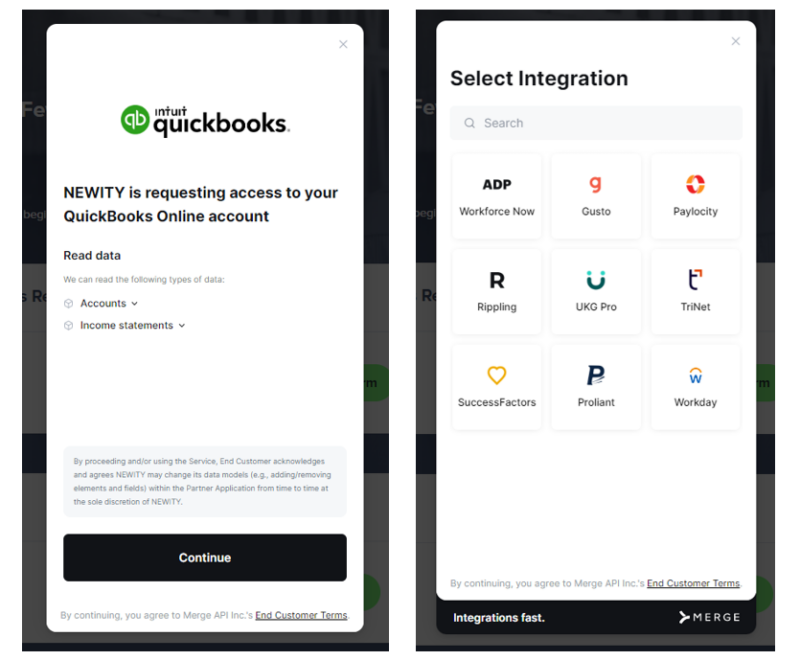

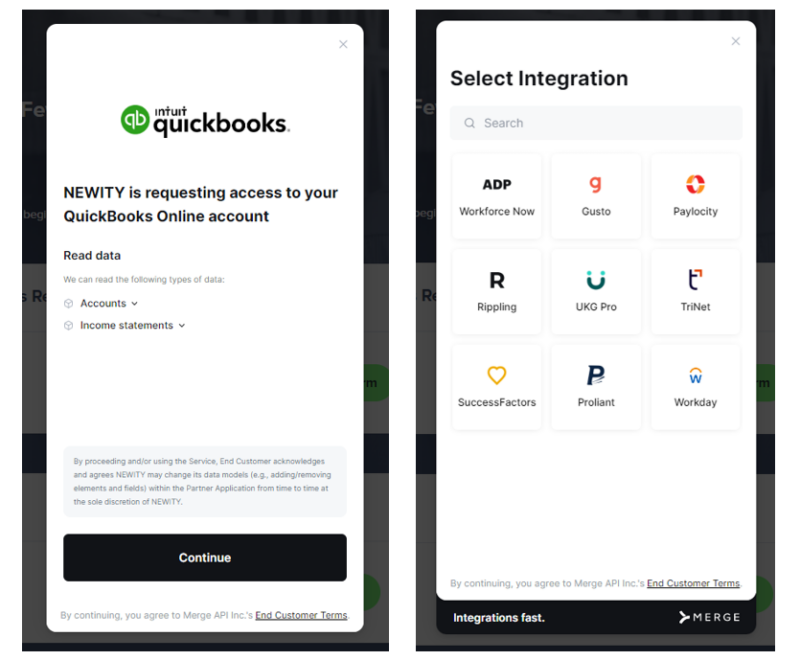

If you chose to connect to the accounting and/or payroll platforms via Merge, a screen will appear to display the available accounting and payroll providers. The Merge feature allows you to log into your accounting or payroll platform to automatically provide income statements and/or payroll from 2019 – 2021 in the proper format. If you do not choose to integrate your accounting and payroll platforms, you can still manually upload documents by clicking the “Upload Documents Manually” button.

Note: The documents requested in Phase One, Income Statements/Gross Receipts and Annual Payroll, must be uploaded to submit your application to NEWITY. You may bypass providing the Phase Two documents for initial application submission, but they will be required to finalize your ERC calculation for IRS submission.

In order to expedite the review process, please be sure all documents and photos are clear and legible before clicking “Submit Documents”.

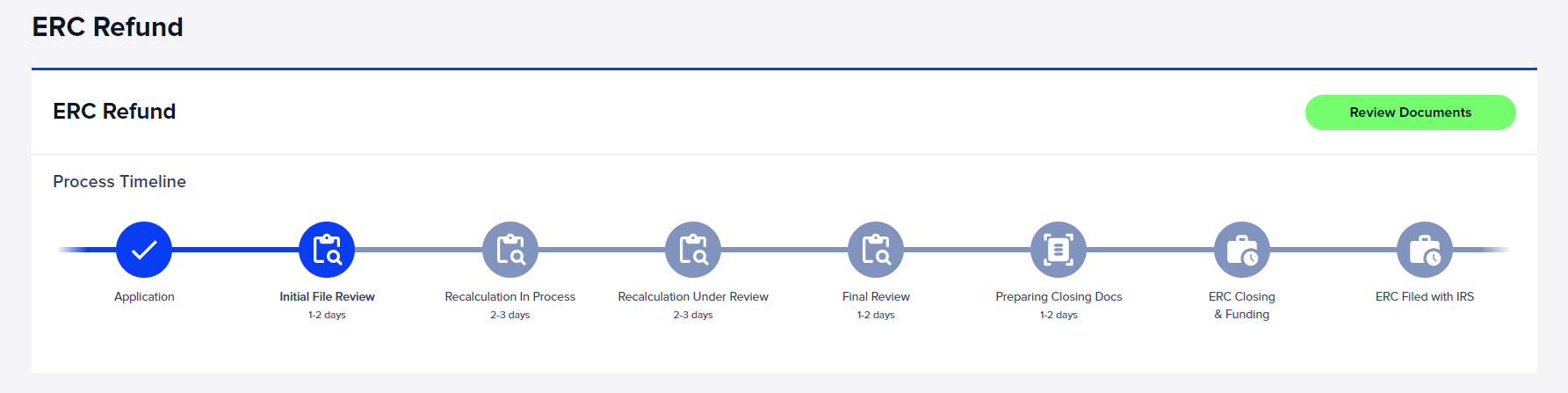

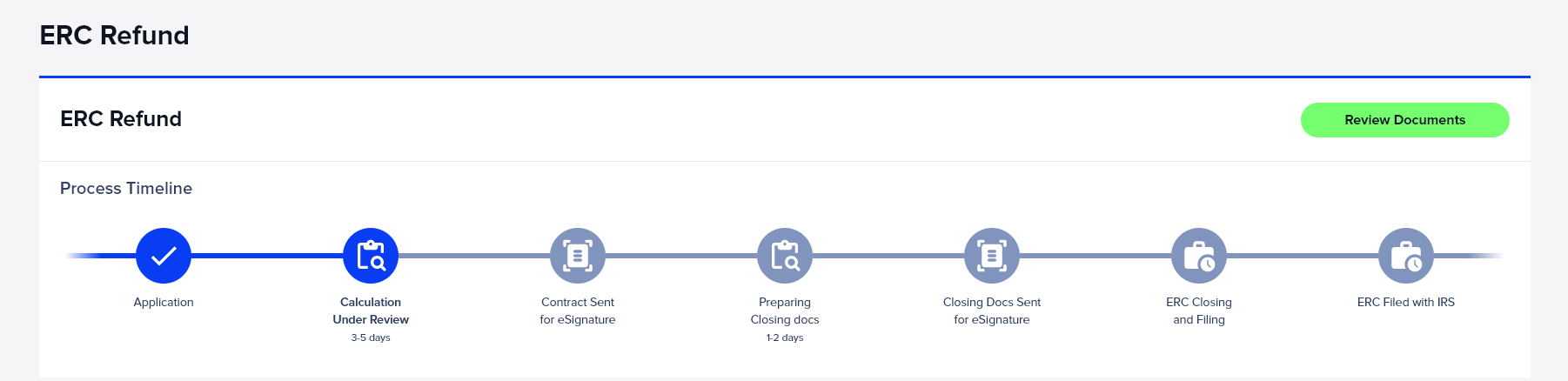

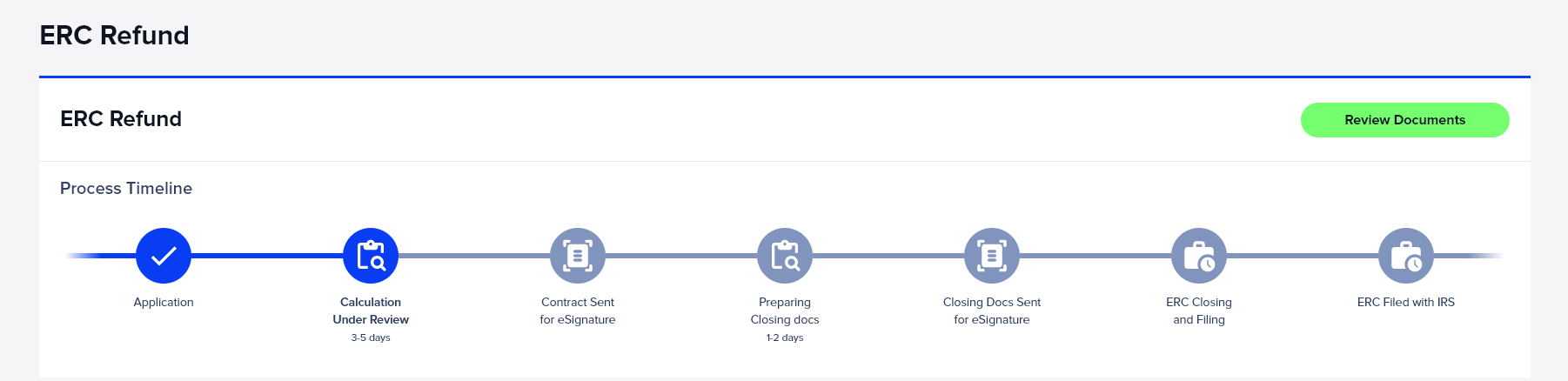

In order to check the status of your ERC Application, please check back to the ERC Refund Process Timeline in your Portal Dashboard. Please visit the ERC Application Status Guide for any additional questions.

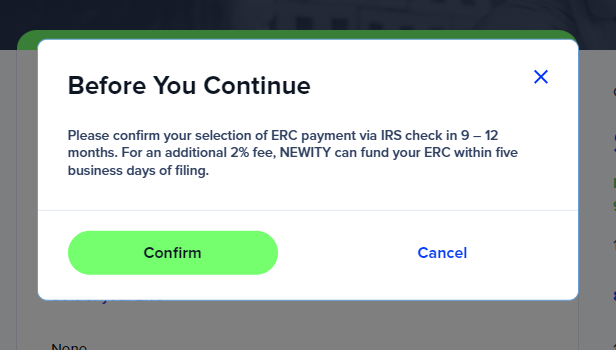

Before accepting and continuing to the next screen, please read and confirm your selection of ERC payment via IRS check in 9-12 months.

In the following Application Details screen, please confirm your ERC refund history data, background information, government aid, and business debt.

In the Business Information screen, please confirm that your business information populated correctly. If it does not appear correctly, please update it.

The Business Details screen captures the authorized signer and business control information. Please be sure to add any additional business owners or family members that are on the business’ payroll. If you are not the owner of the company and do not know the pertinent information for this form, it can also be shared with the contact via email by selecting “No” to the first question on this page. If you are the authorized signer for the business click “Yes” and provide the requested information. Once all information is completed, click “Save & Continue.

Please use the Review and Submit screen to make any last-minute changes via the edit options to the right of each subsection in your application. Once you have completed your review, select “Submit Application” to send your responses to NEWITY for review.

Congratulations! Your ERC application has been successfully submitted. You may return to the dashboard or begin uploading your documents.

Uploading documents is the final step in the ERC Application process.

There are two main sections in the Upload Document screen – Phase One and Phase Two.

If you chose to connect to the accounting and/or payroll platforms via Merge, a screen will appear to display the available accounting and payroll providers. The Merge feature allows you to log into your accounting or payroll platform to automatically provide income statements and/or payroll from 2019 – 2021 in the proper format. If you do not choose to integrate your accounting and payroll platforms, you can still manually upload documents by clicking the “Upload Documents Manually” button.

Note: The documents requested in Phase One, Income Statements/Gross Receipts and Annual Payroll, must be uploaded to submit your application to NEWITY. You may bypass providing the Phase Two documents for initial application submission, but they will be required to finalize your ERC calculation for IRS submission.

In order to expedite the review process, please be sure all documents and photos are clear and legible before clicking “Submit Documents”.

In order to check the status of your ERC Application, please check back to the ERC Refund Process Timeline in your Portal Dashboard. Please visit the ERC Application Status Guide for any additional questions.

I have already filed for ERC.

1. Sign up or log into your account.

Visit https://portal.newitymarket.com to log in or sign up for your account.

View our Account Setup Guide if you need any additional guidance.

FORGOT YOUR PASSWORD?

No problem, click ‘Reset your password’ on the login screen and an email will be sent for you to reset your password.

2. ERC Application - Apply Now

Navigate to the ERC tile within the Smart Portal Dashboard and click the Start Application button.

3. ERC Details

The first screen will ask whether you have or have not yet filed for ERC. Choose “I have already filed an ERC.” This means your business may qualify for ERC Advance. Then click “Save & Continue.”

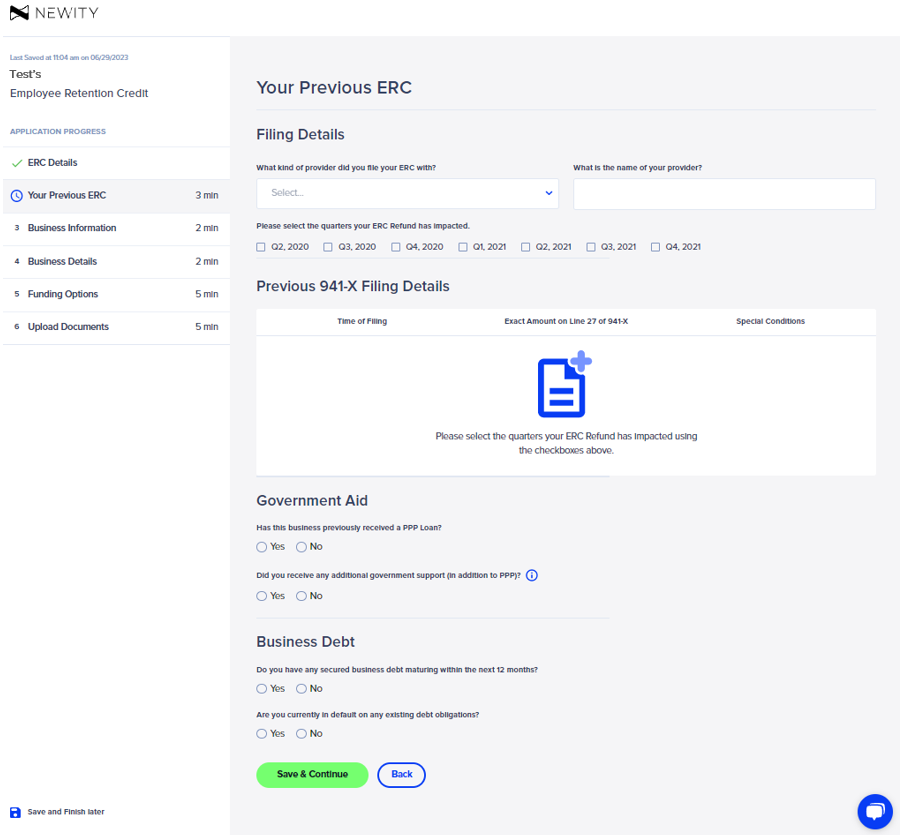

4. Your Previous ERC

Enter the details requested for your business’s previous ERC filing.

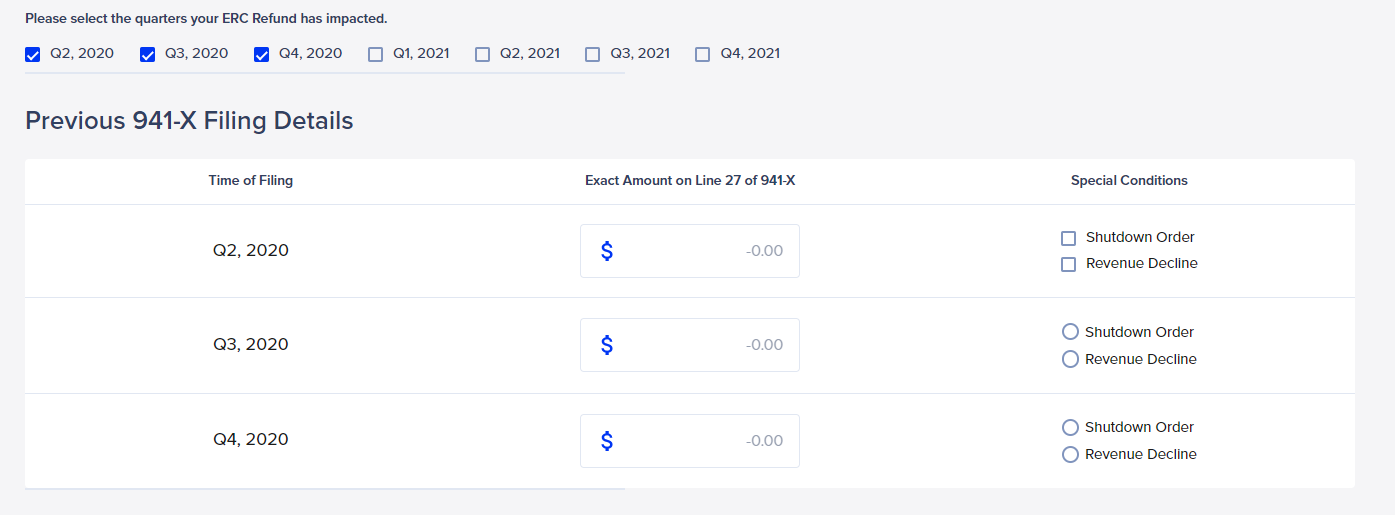

Please provide the exact amount on Line 27 of your Business’s 941-X for each of the quarters your ERC refund has impacted.

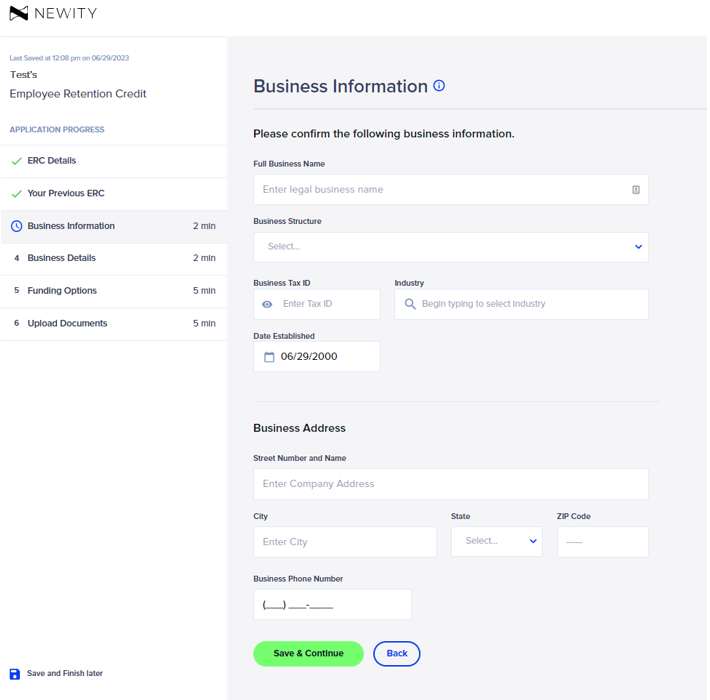

5. Business Information

Please confirm or enter your business information, then click “Save & Continue.”

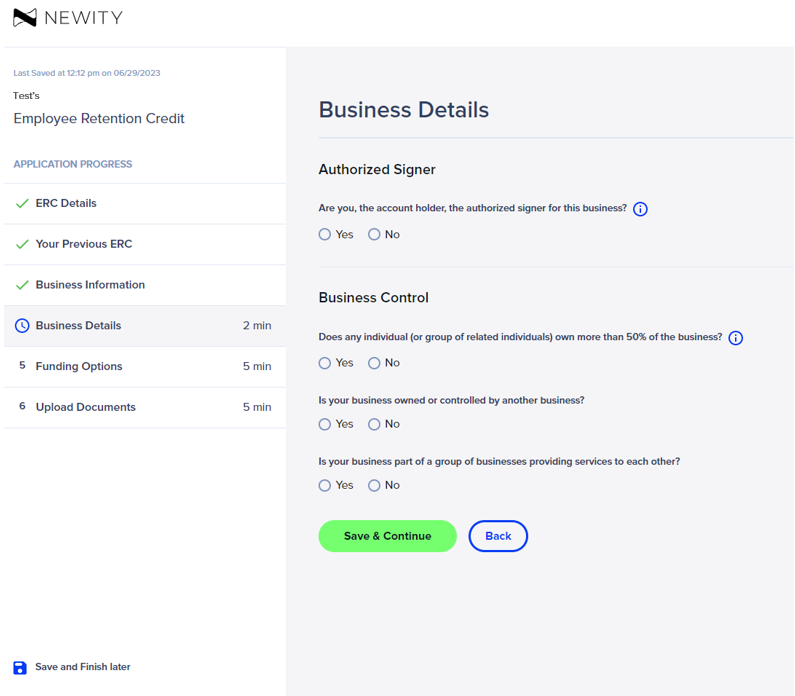

6. Business Details

The Business Details screen captures the authorized signer and business control information. Please be sure to add any additional business owners or family members that are on the business’ payroll. If you are not the owner of the company and do not know the pertinent information for this form, it can also be shared with the contact via email by selecting “No” to the first question on this page. If you are the authorized signer for the business click “Yes” and provide the requested information. Once all information is completed, click “Save & Continue.”

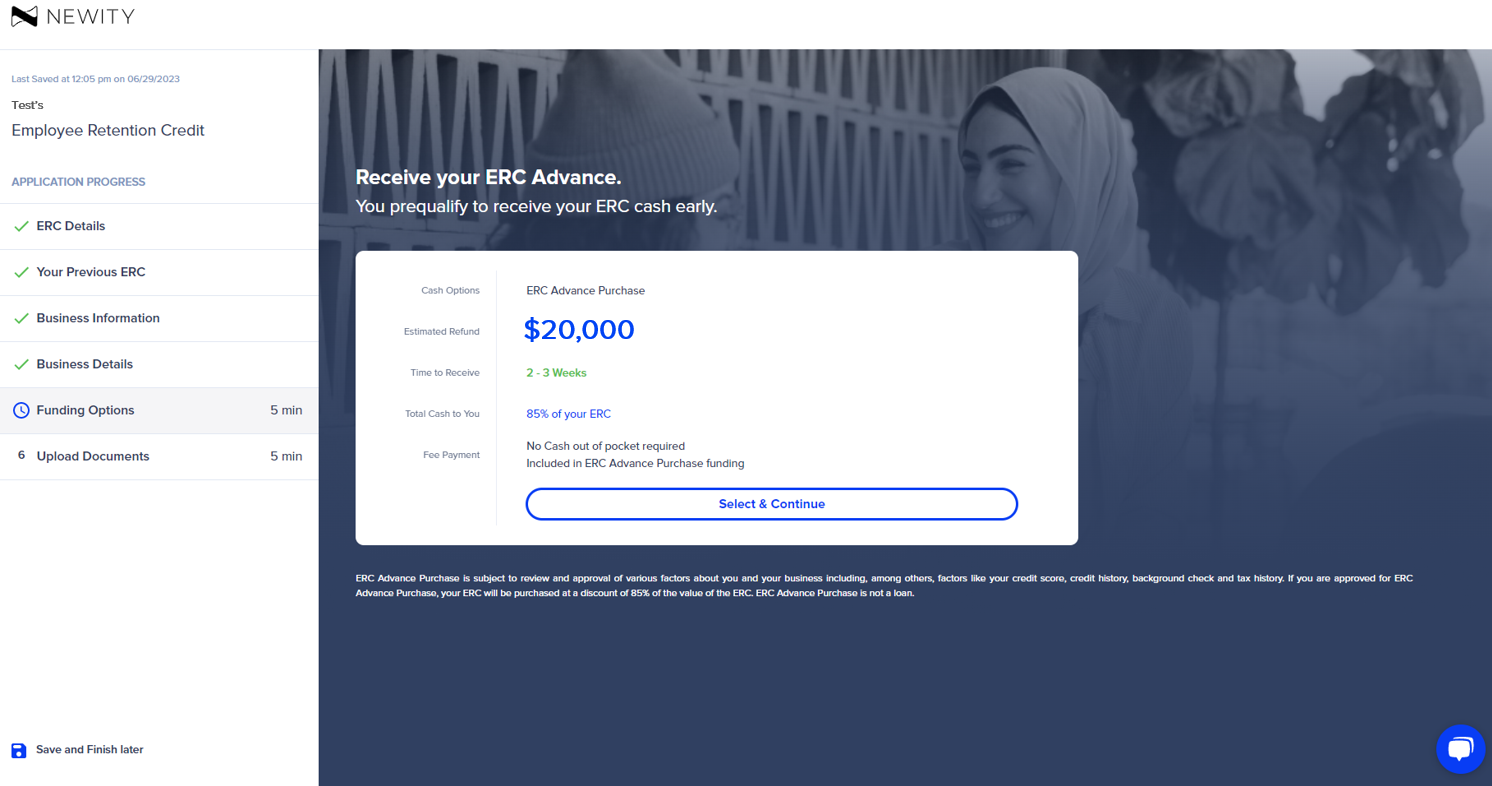

7. Funding Options

The Funding Options screen prequalifies your business to receive your ERC cash early. Here you will see how long it will take to receive your estimated refund. After reviewing, click “Select & Continue.”

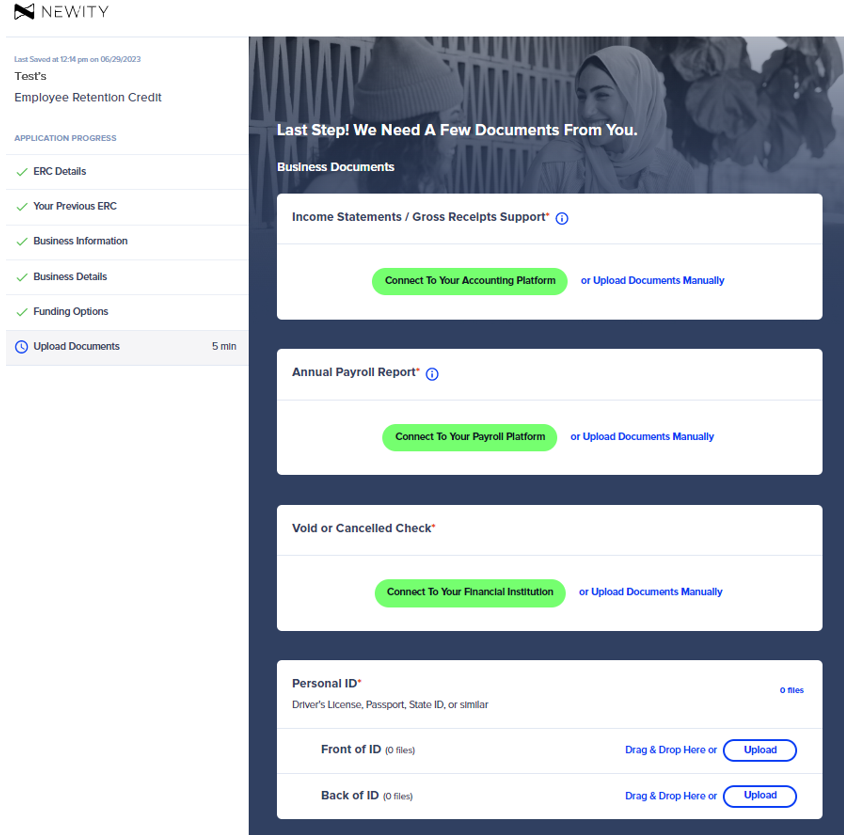

8. Upload Documents

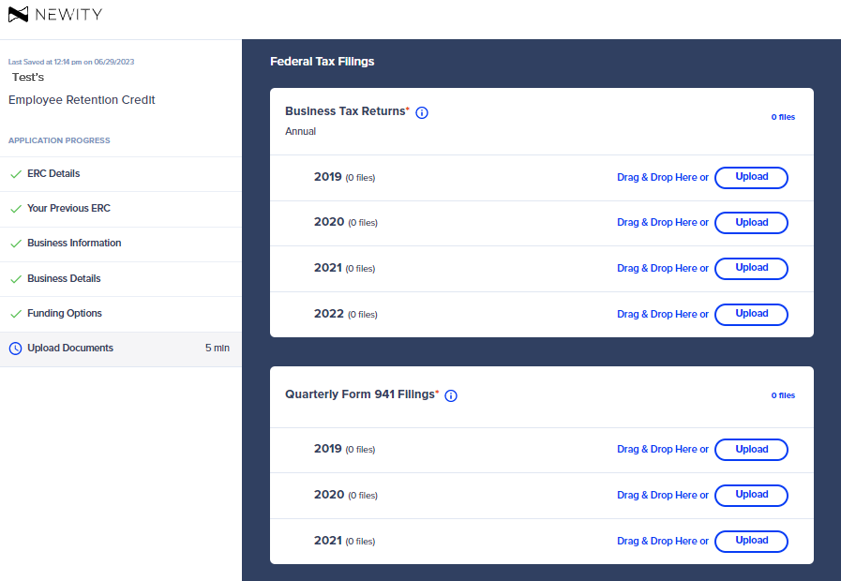

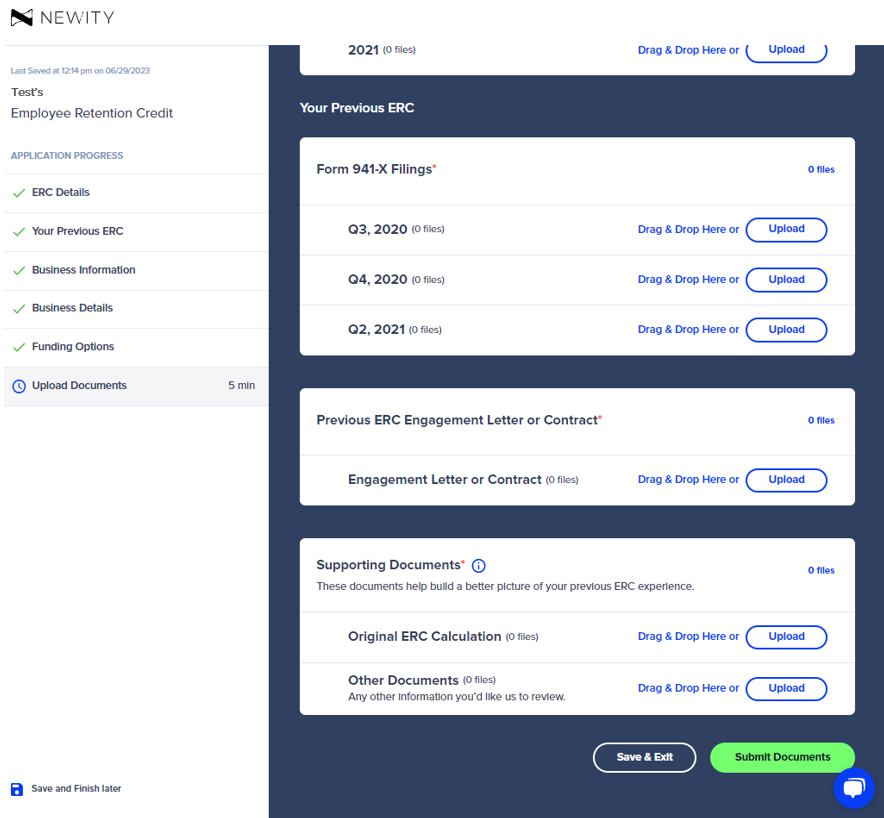

Uploading documents is the final step in the ERC Application process.

There are three main sections in the Upload Document screen – Business Documents, Federal Tax Filings, and Your Previous ERC. You can drag and drop or click the Upload button to provide documents for each section. In order to expedite the review process, please be sure all documents and photos are clear and legible.

Once all required documents are uploaded, click “Submit Documents.”

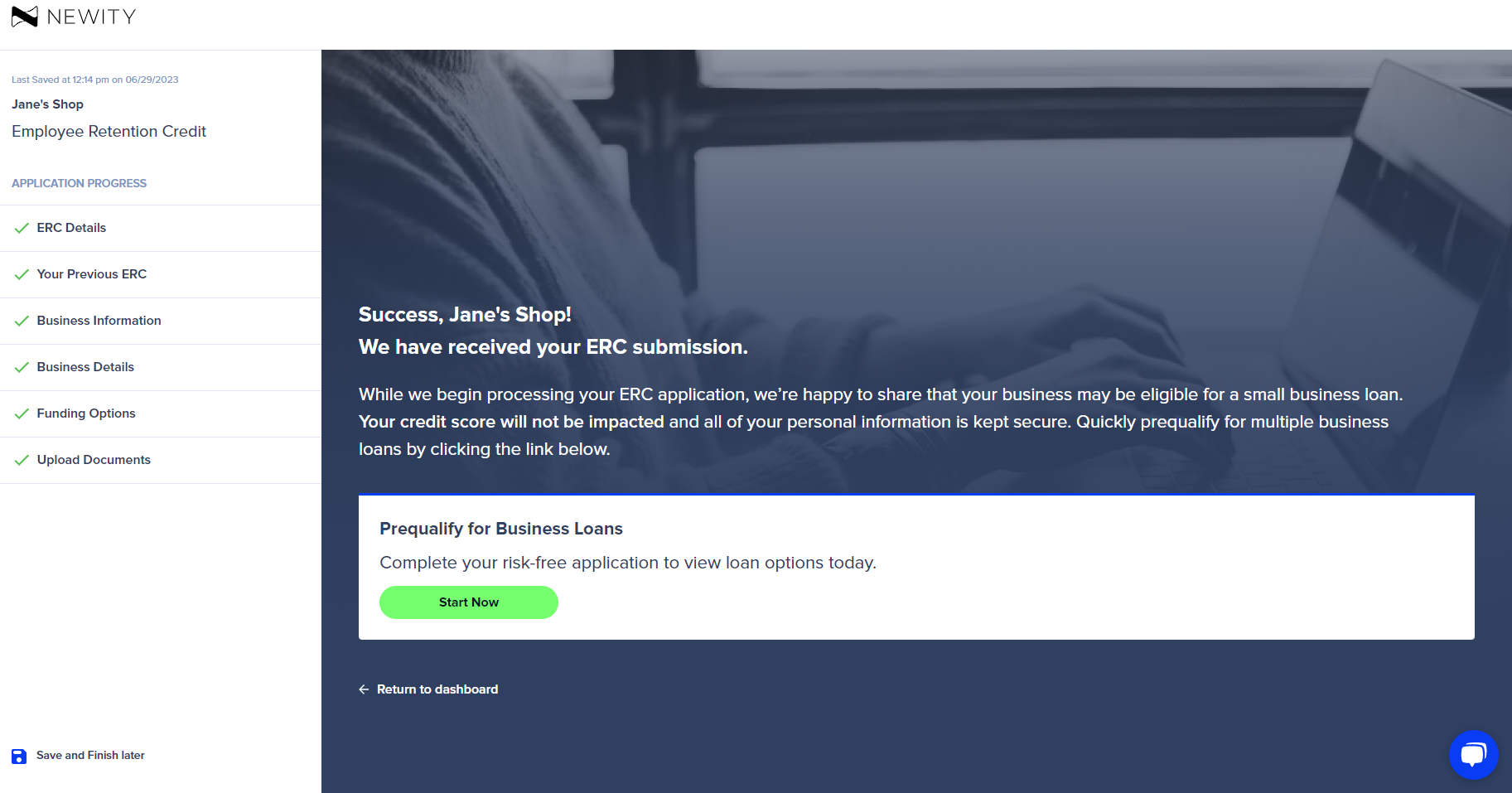

9. Success!

Congratulations! Your ERC Advance application has been successfully submitted. Please look out for an email from the NEWITY team with next steps.

10. ERC Application Progress In Portal Dashboard

In order to check the status of your ERC Application, please check back to the ERC Refund Process Timeline in your Portal Dashboard.