If you have additional individual owners of your business with 20% or more ownership, please follow the steps below to save time and avoid delays in processing your SBA 7(a) Small Business Loan application.

The SBA requires 100% of the business’ ownership is reflected on the application. All owners of 20% or more of the business are required to be personal guarantors for an SBA 7(a) loan.

The Owner Details screen inside the application is intended for the primary individual owner which is also the primary guarantor only. You will be able to include additional owners of the business in an individual, guarantor, or business capacity on the next screen.

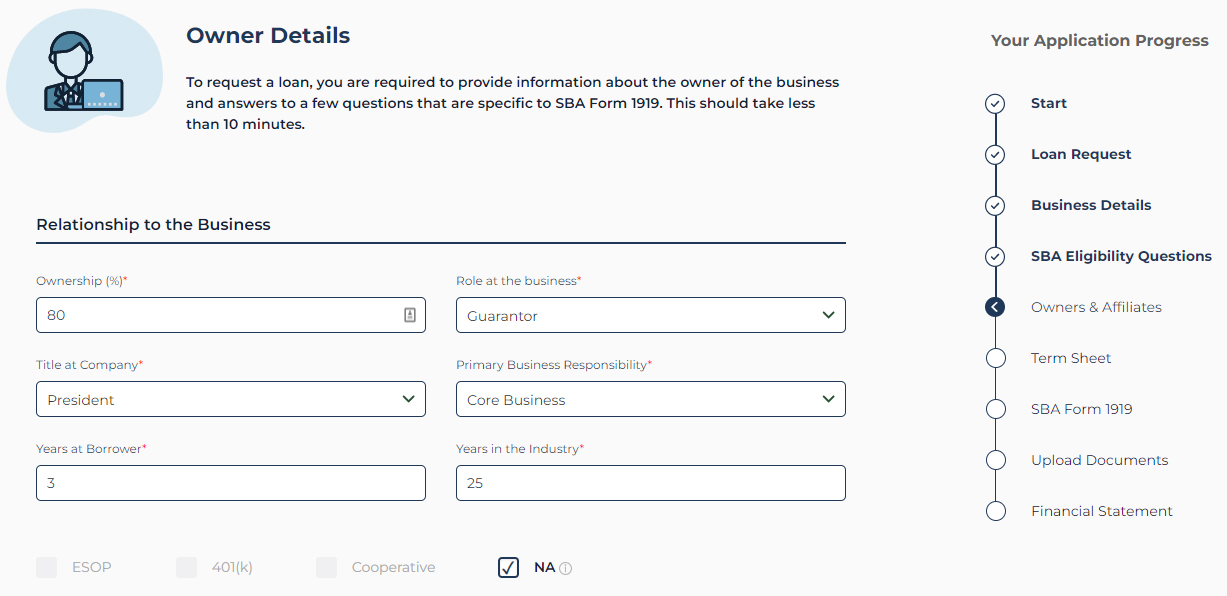

Owner Details

Relationship to the Business Section

- In the Ownership (%) field, enter the primary individual owner’s current ownership percentage of the business. Please note that this information will be verified by the assigned Relationship Manager when the application and required documentation are submitted. percentage on the Owner Details screen first. You will be able to add the business as the primary owner of the applicant business on the next screen.

- In the Role at the Business field, please ensure that Guarantor populates for the primary individual owner if their ownership percentage is 20% or greater. Please note this selection should automatically populate for you if you enter a number equal to or greater than “20” in the Ownership (%) field.

Pro Tips: Please note that if the primary owner of the applicant business is another business, please enter the primary individual owner with the highest current ownership, and if the primary owner of the applicant business is another business and their ownership percentage is 20% or greater, they will be considered a guarantor.

Pro Tips: Please note that if the primary owner of the applicant business is another business, please enter the primary individual owner with the highest current ownership, and if the primary owner of the applicant business is another business and their ownership percentage is 20% or greater, they will be considered a guarantor.

Personal Details Section

- In the First Name field, enter the Full Legal First Name of the primary individual owner exactly as it appears on their personal identification (state driver’s license, state identification, U.S. Passport, or Permanent Resident Card).

- In the Last Name field, enter the Full Legal Last Name of the primary individual owner exactly as it appears on their personal identification (state driver’s license, state identification, U.S. Passport, or Permanent Resident Card).

- In the SSN or ITIN field, enter the SSN of the primary individual owner of the business.

- In the Date of Birth field, enter the DOB of the primary individual owner exactly as it appears on their personal identification (state driver’s license, state identification, U.S. Passport, or Permanent Resident Card).

- Please ensure the primary individual owner selects the “I am an authorized signatory” checkbox. Please note that you will be unable to proceed with the application unless this checkbox is selected by either the primary individual owner or any additional owners, if applicable. If the business has additional owners and they have signing authority, you will be able to include the additional owners later in the application and they will have the opportunity to select this checkbox if the primary individual owner did not select the checkbox.

- Pro Tip: If the business has multiple owners and the primary individual owner selected the “I am an authorized signatory” checkbox, this checkbox will not be available for the additional owners to select on their Owner Details screen later in the application.

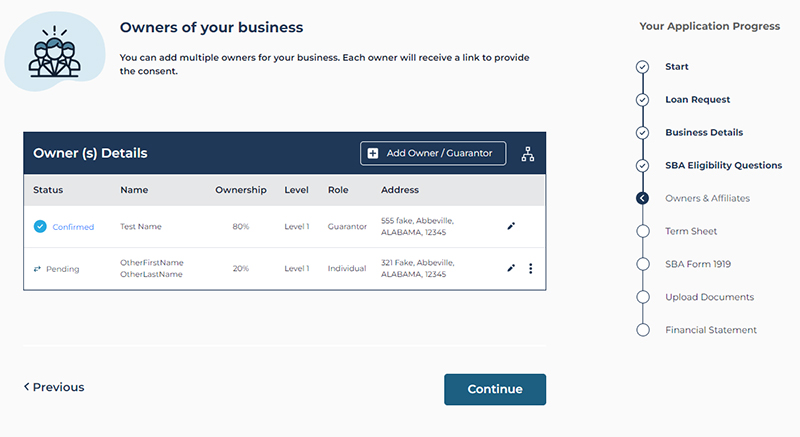

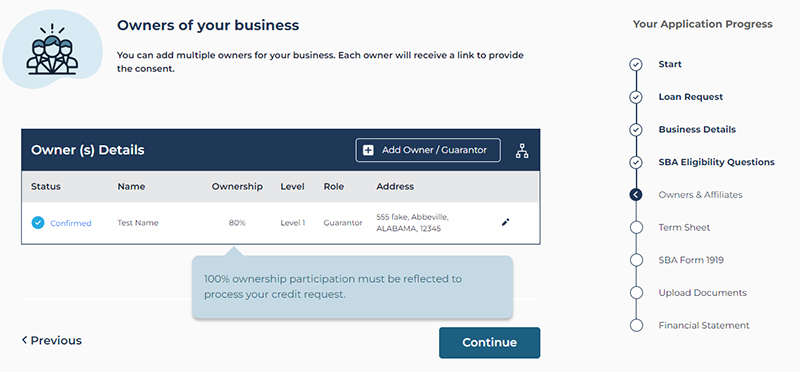

Owners of Your Business

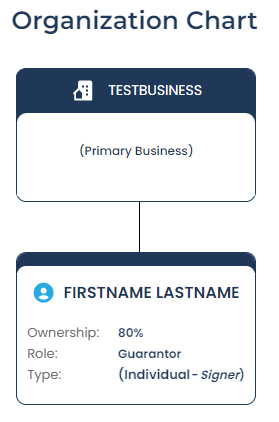

This screen is the summary of ownership of your business that has been provided. Select the Chart icon to the right of the Add Owner/Guarantor button to see a visual summary of the entity and owner information.

If anything is incorrect, simply use the Previous button in the lower left corner of the screen to navigate backward and make edits to this section. Additionally, if an edit is needed for the primary owner or any additional owner, you may also select the Pencil icon to edit their personal details.

If you attempt to move forward with the application without disclosing 100% of the ownership of the business, you will receive the error message below:

To add an additional individual guarantor (all owners of 20% or more of the applicant business), follow the steps below:

- Select the Add Owner/Guarantor button and then select Add Guarantor.

- Select the dial next to Individual. The required fields for the additional individual guarantor will then populate

- Pro Tip: The Role at the Business field will automatically populate as Guarantor.

Additional Owner Details Screen

Individual Details Section

- In the First Name field, enter the Full Legal First Name of the additional individual guarantor exactly as it appears on their personal identification (state driver’s license, state identification, U.S. Passport, or Permanent Resident Card).

- In the Last Name field, enter the Full Legal Last Name of the additional individual guarantor exactly as it appears on their personal identification (state driver’s license, state identification, U.S. Passport, or Permanent Resident Card).

- In the Ownership (%) field, enter the additional individual guarantor’s current ownership percentage of the business. Please note that this information will be verified by the assigned Relationship Manager when the application and required documentation are submitted.

- Pro Tip: Please note that the additional individual guarantor’s current ownership percentage must be 20% or greater since Add Guarantor was selected. If the additional individual owner’s current ownership percentage is less than 20%, please select the Previous button and then re-add the additional individual owner by selecting Add Owner.

- In the SSN or ITIN field, enter the SSN of the additional individual guarantor of the business.

- In the Email Address field, enter the additional individual guarantor’s current email address. Please ensure this field is accurate as the additional individual guarantor will receive email correspondence to this email address throughout the application process.

- Be sure to completely read each question and answer to the best of your ability, as incorrect answers could affect your eligibility.

- Eligibility Check-in: For SBA loan eligibility, we are required to confirm that your business does not have sufficient cash on hand or other liquidity to finance the loan request.

- If you do not have access to liquidity elsewhere, simply select Yes – Liquidity is Unavailable to move forward. Examples of available liquidity that may impact eligibility includes high personal net worth, easy access to traditional bank financing, or large cash balances on the business’ balance sheet.

- If the primary individual owner (primary guarantor) selected the “I am an authorized signatory” checkbox on the Owner Details screen, this checkbox will appear on the bottom of the screen as shown but will not have the capability to be selected by the additional individual guarantor.

- Select the Continue button.

- You will be brought back to the Owners of your business screen to confirm the personal details of the additional individual guarantor just entered. If an edit is needed to the additional individual guarantor’s personal details, select the Pencil icon to navigate back to the Additional Owner Details screen to make the needed edit(s). Then select the Continue button to save your changes and navigate back to the Owners of your business screen.

- Pro Tip: The blue dialog box displaying the message, “100% ownership participation must be reflected to process your credit request” will disappear once 100% ownership of the business is reflected on this screen.

- To further confirm the details of the additional individual guarantor just entered, select the Chart icon to the right of the Add Owner/Guarantor button to see a visual summary of the entity and additional owner information.

- In the Status column, “Pending” will populate for the additional individual guarantor just entered because they have not provided their consent to the credit check requirement and additional personal details. The additional individual guarantor will have the opportunity to provide their consent and additional personal details once 100% ownership is reflected on this screen and Send Consent is selected.

- The Vertical Ellipse icon will appear next to the additional individual guarantor just entered. There are two options to chose from once this icon is selected, Delete and Send Consent.

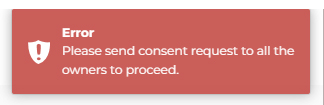

- Pro Tips: You will be unable to send the consent to the additional individual guarantor until 100% ownership is reflected on this screen. If you attempt to send the consent before 100% ownership is reflected, you will receive the error message below:

- If you need to delete the additional individual guarantor just entered, simply select Delete and they will be removed from this screen.

- Select Send Consent. A green confirmation dialog box will appear in the upper right corner of the screen. In the Status column, “Request Sent” will now populate. The Pencil icon next to the additional individual guarantor will disappear and be replaced with the Refresh icon.

- Pro Tips: Ensure the additional individual guarantor’s email address is correct before you select Send Consent. You will not have the capability to edit the additional individual guarantor’s email address once Send Consent is selected. If you determine the additional individual guarantor’s email address or any other personal details were entered incorrectly and you selected Send Consent, please reach out to your Relationship Manager via the Connect to Relationship Manager feature on your 7(a) Portal Dashboard. They will be able to assist you with editing the additional individual guarantor’s email address and any other personal details on their end and resending the consent.

- The consent must be sent to each additional owner and the Status column must reflect “Request Sent” for each additional owner in order to navigate to the next page of the application only when an additional individual guarantor is added to the application. You will be unable to navigate to the next page of the application if you were to select the Continue button without sending the consent to the additional owner. If you attempt to navigate to the next page of the application before sending the consent to each additional owner, you will receive the error message below:

- Note: You do not need to wait for the additional owner to receive and complete the consent before navigating to the next screen and completing the application. Additionally, you do not need to wait for the Status column to reflect “Confirmed” before navigating to the next screen and completing the application.

- Once the consent has been sent to the additional individual guarantor, they will receive an email to confirm the personal details already entered and to provide some additional personal details. Please check your inbox and spam/junk folder for an email from: Newity <[email protected]>. The subject of the email will be Your Attention Required.

- Simply select the link embedded in the email and you will be brought to the My Details screen. The personal details entered previously will populate and there will be new required fields the additional individual guarantor will need to complete. Please confirm the personal details of the additional individual guarantor that populate and edit any field if necessary.

- The additional individual guarantor will be required to answer the following required fields before selecting the Continue button:

- Date of Birth

- In the Date of Birth field, enter the DOB of the additional individual guarantor exactly as it appears on their personal identification (state driver’s license, state identification, U.S. Passport, or Permanent Resident Card).

- Do you own or rent your residence?

- In the Do you own or rent your residence? field, select either Own or Rent.

- Citizenship

- In the Citizenship field, select either I am a U.S. Citizen or I have Lawful Permanent Resident (LPR) status.

- Eligibility Check-In: If the additional individual guarantor is not a U.S. citizen or lawful permanent resident, unfortunately the applicant entity is not eligible for SBA financing.

- In the Citizenship field, select either I am a U.S. Citizen or I have Lawful Permanent Resident (LPR) status.

- Do you have any affiliates?

- In the Do you have any affiliates? field, select either Yes or No. If the additional individual guarantor holds 50% or more ownership of any other business, please select Yes to the affiliates question. You will be able to input the affiliate business’ information and answer simple questions about the capital requirements of that business on the next screen.

- To learn more about the SBA’s affiliation rules, please click here.

- If you indicate Yes to having affiliates, the next screen will be the Affiliate Information screen.

- For more information regarding affiliates and the Affiliates screen, please visit our New 7(a) Small Business Loan Application Guide and New SBA 7(a) Small Business Loan Affiliates Guide.

- In the Do you have any affiliates? field, select either Yes or No. If the additional individual guarantor holds 50% or more ownership of any other business, please select Yes to the affiliates question. You will be able to input the affiliate business’ information and answer simple questions about the capital requirements of that business on the next screen.

- Credit Check Consent checkbox

- Date of Birth

- Select the checkbox acknowledging “I have read, understand and agree to the Credit Check Consent.”

- Select the Continue button. You will then navigate to the Consent Received Confirmation screen. A green confirmation dialog box will also appear in the upper right corner of the screen confirming the consent was received.

- Once the consent has been completed and received by the additional individual guarantor, three actions will occur:

- The primary individual owner (primary guarantor) will receive a confirmation email that the additional individual guarantor has completed the required consent. Please check your inbox and spam/junk folder for an email from: Newity <[email protected]>. The subject of the email will be Consent Provided.

- The Status column on the Owners of your business screen inside the application in the 7(a) Portal will update to reflect “Confirmed.” Additionally, the Refresh icon will disappear next to the additional individual guarantor.

- The additional individual guarantor will receive an email to complete and submit the required documents and the Personal Financial Statement (PFS). Please check your inbox and spam/junk folder for an email from: Newity <[email protected]>. The subject of the email will be PFS and Document.

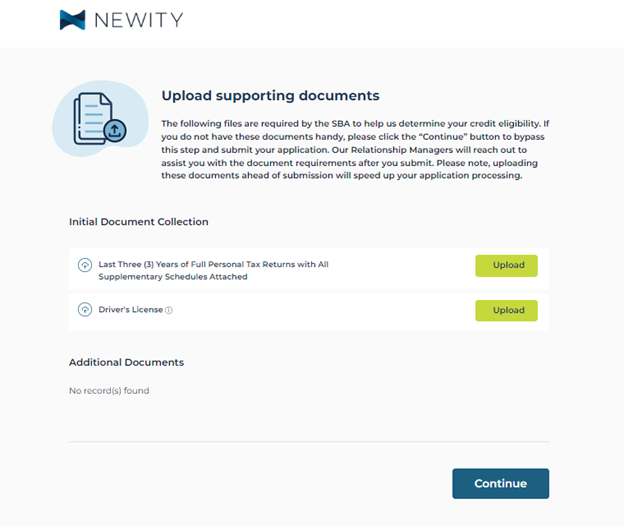

- Please note that all individual guarantors (i.e., owners of 20% or more of the applicant business) are required to provide the individual documents and complete the PFS. Please note, these documents and the Personal Financial Statement are required by the SBA before your loan can be funded.

- Simply select the link embedded in the email and you will be brought to the Upload Documents screen.

- For more information regarding the required documentation and Upload Documents screen, please visit our New 7(a) Small Business Loan Application Guide and 7(a) Loan Document Checklist.

- For more information regarding the required Personal Financial Statement, please visit NEWITY’s Personal Financial Statement page to watch a step-by-step video tutorial to complete the Personal Financial Statement section.

- For more information regarding the Personal Financial Statement screen, please visit our New 7(a) Small Business Loan Application Guide.

- Once the additional individual guarantor has completed the PFS Schedules tab, select the Continue button. Review your entries for accuracy under the PFS Assets & Liabilities tab and select the Continue button to submit your PFS.

- You will then navigate to the PFS and Document(s) Submitted screen.

Congratulations!

You have completed the required actions to add an individual guarantor to your SBA 7(a) Small Business Loan application.